The world’s number-one crypto is looking more like a mature asset class every day as Bitcoin volatility continues to drop (yes, even as it blasts past all-time highs and promptly retraces its steps).

Bitcoin volatility has reached a five-year low

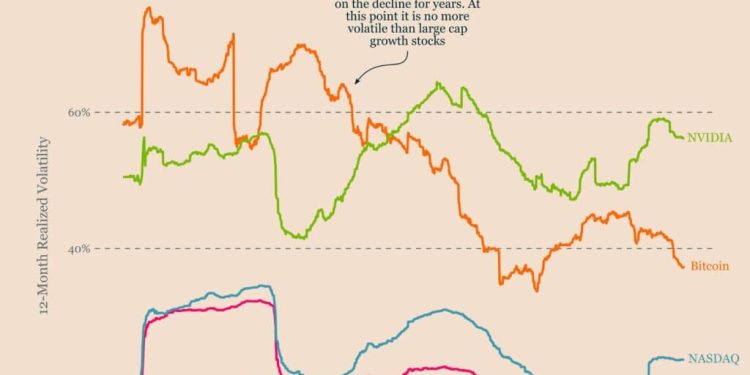

Bitcoin has long been regarded as one of the most volatile financial assets; its turbulent price fluctuations over the years have deterred many investors. But what if I told you that Bitcoin is now less volatile than a blue-chip tech stock?

According to ecoinometrics, Bitcoin’s 30-day realized volatility is now at its lowest point in nearly five years, and it’s a trend that has persisted even through Bitcoin’s headline-making rallies and corrections over the last five years:

“Exactly what you expect from a maturing asset.”

Since 2022, Bitcoin has often been less volatile than some of Wall Street’s biggest names, including mega-cap stocks like Nvidia. During the sharp tech sector swings of 2023 and 2024, Nvidia’s price was more unpredictable than Bitcoin, an asset infamous for its hair-raising moves.

Even during this current Bitcoin bull run, the price swings have remained notably tamer than previous cycles. Macro analyst Lyn Alden recently told CryptoSlate she believes that Bitcoin’s cycles are changing.

We should expect this one to be longer and “less extreme” than previous runs, with strong moves upward followed by periods of consolidation, “rather than going to the moon and collapsing.”

All the signs of asset class maturity

Bitcoin volatility declining is just one marker of its growing maturity. The launch of spot Bitcoin ETFs in the U.S. in early 2024 was a landmark event, opening up the asset to the mainstream audience.

Major asset managers like BlackRock and Fidelity offer direct Bitcoin exposure to retail and institutional investors through regulated exchange-traded products. This has introduced broader ownership and liquidity, dampening large price swings and integrating Bitcoin more deeply into traditional markets.

Moreover, recent regulatory changes now allow Americans to include Bitcoin in their 401k retirement accounts. As diversified portfolios absorb BTC allocations, Bitcoin volatility further subsides.

Pension funds, endowments, and insurance companies have begun allocating to Bitcoin as part of their alternative asset strategies. This increases trading by sophisticated investors and reduces the impact of short-term speculative flows.

Strong-willed kids become adults who change the world

Increasingly, Bitcoin’s price shows a higher correlation with broader equity markets during risk-on and risk-off periods, another sign of integration and maturity. While you can argue whether this is what we intended for Bitcoin, it does reflect mainstream market adoption. And hey, strong-willed kids become adults who change the world, as Bitcoin is undoubtedly doing.

For everyday investors and institutions alike, lower Bitcoin volatility translates to less risk and a smoother investment profile.

It’s also a sign that Bitcoin is outgrowing its adolescent phase of wild speculative swings and turbulence, and settling into its role as a legitimate member of society and staple of diversified portfolios. It’s time to admit, our baby is fully grown.

The post Bitcoin volatility keeps falling, and that means it’s maturing as an asset class appeared first on CryptoSlate.