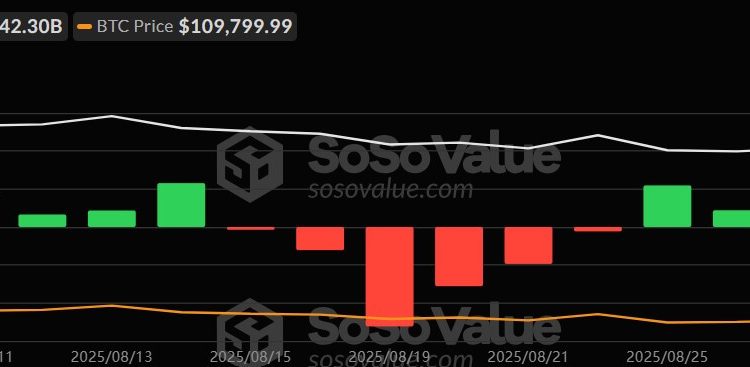

Spot Bitcoin and Ethereum ETFs posted significant outflows of nearly $400 million on Sept. 4, extending the asset class’s week of uneven performance.

According to SoSoValue data, Bitcoin ETFs reversed a two-day streak of inflows and closed with $227 million in net outflows.

Investor pullback was most evident across flagship products, as Fidelity’s FBTC saw $117.45 million in redemptions, Ark Invest’s ARKB dropped $125.49 million, and Bitwise’s BITB faced $66.37 million in outflows.

In contrast, BlackRock’s IBIT was the lone bright spot, attracting $134.71 million in inflows, though this was outweighed by losses elsewhere.

Institutional interest in Ethereum ETFs

The losses were also pronounced on the nine Ethereum ETFs side.

The ETH-focused ETFs saw $166.38 million in outflows, marking the fourth consecutive day of withdrawals. BlackRock’s ETHA absorbed $149.81 million exits on the day, but Fidelity’s FETH processed a larger $216.68 million redemption.

Additional declines came from Bitwise’s ETHW ($45.66 million), VanEck’s ETHV ($17.22 million), and Grayscale’s flagship ETHE ($26.44 million).

Meanwhile, Grayscale’s mini ETH fund shed $6.44 million, while Invesco’s QETH and Franklin’s EZET posted more minor losses of $2.13 million and $1.62 million, respectively.

Glassnode data shows that institutional participation remains active in Ethereum markets despite the downturn. According to the firm, rising open interest on the CME has mirrored more than half of all ETH ETF inflows.

This trend suggests that traditional finance institutions are not solely chasing price exposure. Instead, they appear to be combining outright directional trades with arbitrage strategies as ETH trades below its recent local highs.

The post Bitcoin and Ethereum ETFs lose almost $400M but institutional interest still active appeared first on CryptoSlate.