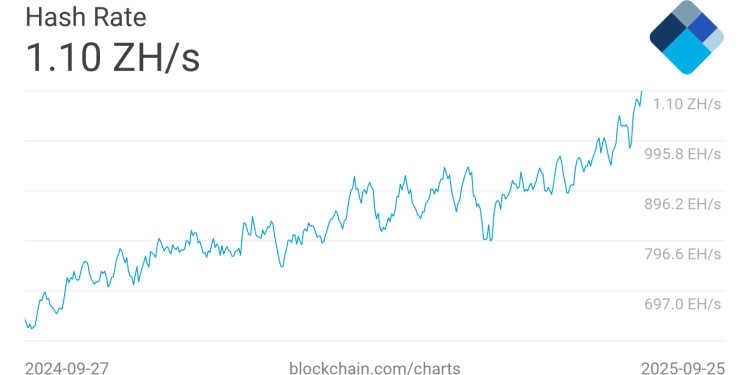

On Sep. 23, Bitcoin’s hashrate set a new all-time high of 1,073 EH/s. Over the last month, raw compute rose about 21%.

Over the last quarter, roughly 70%. Over the last year, the curve went vertical, up around 675%.

Hashrate used to be a chart for miners and protocol nerds. Now it reads like a capital expenditure scoreboard for an industry you can trade.

Let’s answer the basic question quickly: What is hashrate, and why should anyone outside a mining warehouse care?

Hashrate is the total computational effort pointed at Bitcoin’s proof-of-work: i.e., how hard it would be to outvote the network and rewrite the ledger. More hashrate makes an attack more expensive and less practical. But the more interesting angle isn’t just “safety”; it’s what this says about the scale of the industry behind it.

You don’t get a zetahash without years of setting up facilities, installing transformers, hauling in container loads of machines, and locking in energy contracts big enough to power entire towns. Every uptick on this line is money and engineering showing up in the real world.

Mechanically, the protocol keeps block cadence steady by raising or lowering difficulty every 2016 blocks, like a treadmill that speeds up when the runners get stronger. When hashrate jumps like it did into September, the treadmill kicks faster on the next epoch or two, and margin gets tighter.

That feedback loop drives the business: machines come online, blocks arrive too quickly, difficulty adjusts, and unit economics compress until only the most efficient operators keep their edge. The protocol is agnostic; it doesn’t negotiate. Miners either hit their power price and fleet-efficiency targets or they get pushed to the back of the line.

The latest daily print set a fresh high around 1,073 EH/s. The past 30 days added roughly 184 EH/s at the peak of the run-up, an absolute jump big enough to have counted as the entire network not long ago.

Year to date, hashrate is up about 36%. The series crossed each psychological marker on a predictable cadence: 1 EH/s in early 2016, 10 EH/s by late 2017, 100 EH/s by late 2019, 500 EH/s in late 2023, and now four-comma territory. These thresholds marked step-ups in industrial scale: new-gen ASIC waves, denser racks, better firmware, and cheaper electricity.

This is where “why hashrate matters beyond mining” becomes the wrong lens to look at it. It matters a lot for mining because public miners now sit at the center of this industry. MARA, RIOT, CLSK, CORZ, IREN, CIFR, and peers aren’t just trading proxies for Bitcoin; they are operating companies tied to this treadmill.

When hashrate accelerates faster than price, difficulty chases it, and hashprice compresses. You can see that shake out on earnings calls: fleet age and watts per terahash suddenly matter more than clever treasury lines.

Operators with sub-$0.04-$0.05/kWh power, efficient immersion or high-utilization air-cooled sites, and firmed power hedges ride the adjustment without coughing up margin. Everyone else watches their breakeven rise.

The equity market side of this is simple to narrate and hard to run.

Scale is now a real infrastructure problem: substation lead times, transmission constraints, interconnect queues, and localized politics about where you can place load. That’s why the hashrate chart reads like a map of who actually executed.

A network that just cleared one zetahash is an industry with hard assets all across the world, grouped in regions with cheap power and a supporting local government. The stock tape reflects that sorting.

Companies with fresh fleets and readily available megawatts capture share into an upswing; the rest get diluted, consolidated, or quietly sidelined when the next difficulty ratchet arrives.

The industry is always tempted to turn hashrate spikes into price calls.

However, the better story here is that price reflects mood while hashrate reflects commitment. Rigs don’t magically appear because social sentiment turned green. The move we just logged implies months of capex already spent and months more queued up for delivery.

If spot stalls, difficulty will still do its job and force the industry to get leaner. If price runs with it, you’ll see the public names sprint as operational leverage flips positive.

The past month’s +20% and the quarter’s +70% aren’t just big; they’re fast. The single largest 30-day absolute gain in this run hit in mid-September, a reminder that the cadence of deployments is now lumpy as containers land in bursts, power comes online in chunks, and grid seasons matter.

That rhythm is what will decide the leaderboard over the next few epochs.

You can fake a narrative. You can’t fake delivered power.

The post Why Bitcoin’s hashrate explosion could squeeze public miners next appeared first on CryptoSlate.