JPMorgan is calling Bitcoin the “debasement trade,” which means you’re probably not bullish enough. The world’s biggest investment bank doesn’t hand out nicknames for speculative assets lightly. But Bitcoin has notched 17 years of unstoppable block-after-block resilience, and Wall Street has finally conceded what the cypherpunks have known all along: there is no alternative when trust in fiat runs thin. Like it or not, the moment for cautious optimism has passed.

JPMorgan and the ‘debasement trade’

Wall Street is infamous for its double-speak, but JPMorgan’s latest missives cut surprisingly close to the core. By framing Bitcoin as the “debasement trade,” they’re explicitly telling clients: in a world where stimulus checks, trillion-dollar deficits, and rate cuts into persistent inflation are the norm, holding cash or bonds is a mug’s game. To borrow the words of TFTC founder Marty Bent:

“You are not bullish enough.”

It’s not about speculation anymore. It’s about defense. As the dollar’s purchasing power takes its slow, ceaseless tumble, Bitcoin’s capped supply and trustless design feel tailor-made for this era.

With central banks performing fiscal acrobatics and the U.S. government running yearly deficits north of $2 trillion, “asset protection” becomes synonymous not with blue-chip dividends, but with digital scarcity.

If JPMorgan’s institutional clients are piling into Bitcoin, it’s because they see what’s coming: a tide of debasement that no rate hike or fiscal promise will reverse.

‘You grow yourself out of that debt’

Cue President Trump’s recent remarks that America “will grow [itself] out of that debt.” Optimism is part of the political job description, but growth alone won’t patch trillion-dollar holes overnight. Stimulus checks fly at each crisis, rate cuts support markets while inflation simmers, and every solution seems to create two new problems.

Underneath this fiscal pageantry, Bitcoin quietly explodes in relevance. Every round of monetary stimulus, every debt-fueled spending spree, every government shutdown suspending key jobs data are tailwinds for Bitcoin.

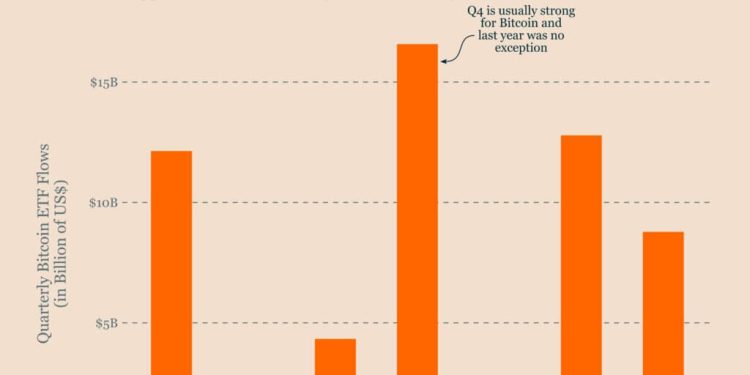

As Ecoinometrics observes, Q4 is historically bullish for Bitcoin. Year-end portfolio rebalancing, bonus checks searching for yield, institutions scrambling to front-run the latest rate cut or stimulus announcement.

Last year’s EFT flows helped take the price from $60,000 to over $100,000. If flows pick up again, we could be looking at $135,000 per coin by this time next month.

That’s not all. Don’t forget the analysts year-end predictions. Citigroup forecasted a $133,000 BTC, JPMorgan went with $165,000, stating that Bitcoin was underpriced compared to gold, and Standard Chartered estimated a whopping $200,000. As Bitwise CIO Matt Hougan remarked:

“Q4 is going to be fun.”

Where macro meets momentum

Bitcoin isn’t just a trade. It’s rapidly cementing itself as the “debasement hedge;” the asset with the best asymmetric risk-reward profile in a market addicted to liquidity.

Last year, the ETF rush gave Bitcoin its most powerful quarterly close, pushing it well above the psychological $100,000 barrier. Every sign points toward a replay, especially with U.S. deficit spending and another round (or two) of Fed rate cuts slated for 2025, all while Bitcoin’s supply remains untouched at 21 million.

Let’s get this out in the open: You are not bullish enough, and the evidence backs it up. For almost 17 years, Bitcoin has proven itself more resilient, more predictable, and frankly, more trustworthy than the institutions whose logos once served as bywords for financial safety.

When JPMorgan treats Bitcoin as a core defensive play, it isn’t just a bet on tech; it’s a bet against the old order.

The post Why JPMorgan is calling Bitcoin the “debasement trade” appeared first on CryptoSlate.