When Amazon Web Services (AWS) faltered this morning, much of the internet went dark, and crypto was no exception.

Several major blockchains and trading platforms, including Coinbase, Robinhood, and some Ethereum layer-2 networks, reported disruptions after AWS suffered an operational failure linked to its DynamoDB database service.

According to Amazon’s status page, the issue began in the US-EAST-1 region and caused cascading slowdowns across 58 services globally.

The firm explained:

“Based on our investigation, the issue appears to be related to DNS resolution of the DynamoDB API endpoint in US-EAST-1. We are working on multiple parallel paths to accelerate recovery. This issue also affects other AWS Services in the US-EAST-1 Region. Global services or features that rely on US-EAST-1 endpoints such as IAM updates and DynamoDB Global tables may also be experiencing issues.”

As a result, Down Detector logged outages across more than 50 platforms, from airlines and streaming sites to social apps like Snapchat and Signal.

Notably, this latest incident was Amazon’s second major outage this year, following one in April.

Centralized cloud, decentralized consequences

AWS underpins a vast share of the world’s internet infrastructure, providing cloud storage and computing power to hundreds of companies that rely on its uptime. In crypto, that dependency is proving hard to ignore.

Coinbase confirmed that the outage temporarily limited user access but said its systems are now recovering. Robinhood reported a similar restoration of service.

Meanwhile, Base, Coinbase’s Ethereum layer-2 network, posted that the AWS outage impacted its infrastructure and reduced its capacity.

Notably, blockchain infrastructure providers were also not spared from the outage.

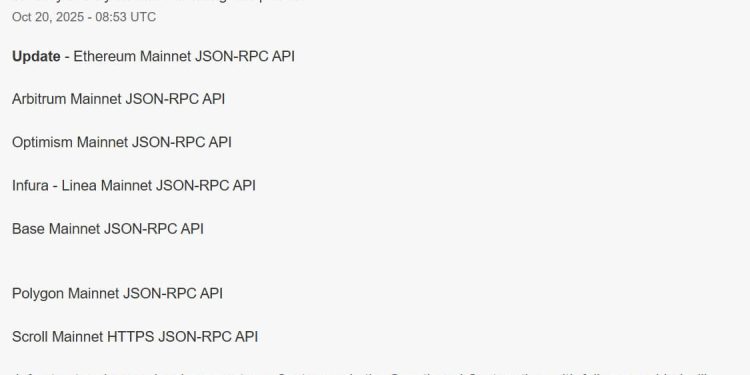

Consensys-backed Infura, the backend service that connects crypto wallets like MetaMask to blockchains, said the disruption affected its users’ connection to Polygon, Optimism, Arbitrum, Linea, Base, and Scroll.

Why does AWS outage keep affecting crypto?

Given the scale of these impacts, Lefteris Karapetsas, founder of the privacy-focused portfolio tracker Rotkiapp, said:

“The whole vision behind blockchain was decentralized infrastructure, which we have completely failed on.”

The reality is that several blockchain networks’ infrastructure still runs on centralized servers.

For context, data from Ethernodes shows that AWS hosts roughly 2,368 Ethereum execution layer nodes, accounting for about 37% of the network’s total.

This means that a technical issue at the provider or even one of its data center can slow entire ecosystems built on top of it.

Still, an AWS outage won’t bring Ethereum to a halt as other nodes hosted on competing clouds or self-run hardware will continue to process transactions.

Nonetheless, this concentration level underlines how much “decentralized” crypto depends on centralized pipes.

Despite the philosophical tension posed by this reliance, cloud hosting remains the easiest path for smaller crypto projects.

Indeed, running nodes in-house requires expensive hardware, stable electricity, and bandwidth. These are resources that large data centers provide at scale.

This makes AWS cheaper, “reliable,” and faster to deploy for start-ups.

However, that convenience trades resilience for efficiency because an overreliance on a few cloud providers creates structural risk for the emerging industry.

Decentralized alternatives?

The outage reignited debate over the need for decentralized cloud compute systems that mimic AWS’s functionality but distribute storage and processing across independent participants.

Ahmad Shadid, CEO of O.XYZ, told CryptoSlate that such a transition won’t be easy.

According to him:

“AWS has an insane amount of data centers. If decentralized cloud compute providers want to compete, they need to have as many, if not more, data centers… Is that even feasible? Where are you going to get the electricity from?”

While he conceded that these decentralized solutions could “utilize consumer GPUs and other such resources.”

However, he questioned how these platforms will “find enough consumer GPUs and other such resources equivalent in compute power to the compute power that AWS provides to all its clients.”

Still, crypto enthusiasts believe that projects like Filecoin and Arweave offer promise because they are censorship-resistant, cost-efficient options that align more closely with crypto’s ethos.

Notably, crypto market data supports that narrative, with tokens linked to decentralized storage protocols being among the best-performing assets in the past 24 hours, according to CryptoSlate’s data.

The post How today’s AWS glitch took down Coinbase, ETH L2s, and half the internet appeared first on CryptoSlate.