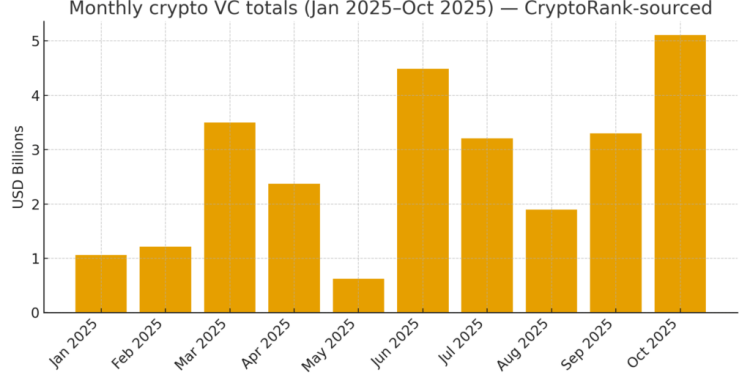

October closed roughly 4% down for Bitcoin, yet venture funding hit $5.1 billion in the same month, the second-strongest month since 2022.

According to CryptoRank data, three mega-deals account for most of it, as October defied its own seasonal mythology.

Bitcoin fell 3.7% during a month traders have nicknamed “Uptober” for its historical winning streak, breaking a pattern that had held since 2019.

Yet venture capitalists deployed $5.1 billion into crypto startups during the same 31 days, marking the second-strongest monthly total since 2022 and the best VC performance of 2025 aside from March.

The divergence between spot market weakness and venture market strength creates a puzzle, where either builders see something that traders have missed, or a handful of enormous checks have distorted the signal.

The concentration tells most of the story. Three transactions account for roughly $2.8 billion of October’s total of $5.1 billion: Intercontinental Exchange’s (ICE) strategic investment of up to $2 billion in Polymarket, Tempo’s $500 million Series A round led by Stripe and Paradigm, and Kalshi’s $300 million Series D round.

CryptoRank’s monthly data shows 180 disclosed funding rounds in October, indicating that the top three transactions account for 54% of the total capital deployed across fewer than 2% of deals.

The median round size is likely in the single-digit millions. Removing Polymarket, Tempo, and Kalshi from the calculation would shift the narrative from “best month in years” to “steady but unspectacular continuation of 2024’s modest pace.”

The “venture rebound” narrative depends heavily on whether people count a strategic acquisition play by the New York Stock Exchange’s parent company and two infrastructure bets as representative of broader builder confidence or as outliers that happened to close in the same reporting window.

Why spot traders sold while VCs wrote checks

Bitcoin’s October weakness stemmed from profit-taking following September’s gains, macroeconomic headwinds from rising Treasury yields, and continued ETF outflows that began mid-month and accelerated through the final week.

Although Bitcoin ETFs registered nearly $3.4 billion in net inflows, Farside Investors’ daily flow data shows heavy redemptions from major spot Bitcoin products, particularly in the final ten trading days.

Venture capital operates on a different clock. The firms deploying capital in October committed to thesis-driven positions months earlier.

The actual cash transfer and announcement timing reflect legal processes and strategic coordination rather than spot market sentiment.

Polymarket’s $2 billion from ICE doesn’t reflect a bet on Bitcoin’s November price, but rather reflects ICE’s view that prediction markets represent a multi-billion-dollar addressable market where first-mover advantage and regulatory positioning matter more than token price action.

Tempo’s $500 million round funds stablecoin and payment infrastructure aimed at enterprise adoption. Revenue-generating products whose success metrics don’t directly correlate with whether Bitcoin trades at $100,000, $60,000, or $40,000.

Kalshi’s $300 million raise operates in similar territory. The CFTC-regulated prediction market platform competes with Polymarket and traditional derivatives venues, and its valuation has jumped to $5 billion based on transaction volume growth and a regulatory moat, rather than crypto market timing.

The three largest October deals share a common thread: they target infrastructure, compliance, and institutional use cases where crypto serves as plumbing rather than speculation.

That focus explains why venture activity can surge while retail traders exit, as VCs placed their bets on the decade-long buildout of financial infrastructure, not the next quarter’s price movement.

The risks in mega-deal concentration

Concentration creates fragility. If Polymarket faces regulatory headwinds, or if Tempo’s enterprise pipeline develops more slowly than projected, two of October’s flagship deals could mark peak valuations rather than validated milestones.

The same concentration that inflated October’s headline number makes the sector vulnerable to downward revisions if those few large bets stumble.

The timing also warrants caution. ICE announced its Polymarket investment days before the US mayoral elections, positioning the platform to capitalize on what became record prediction market volume.

That timing reflects strategic opportunism, as ICE bought into heightened visibility and user growth, but raises questions about sustained engagement if election-driven volume returns to normal.

Kalshi’s $300 million came amid similar election-related momentum. Both deals may prove prescient if prediction markets sustain post-election activity, or they may represent peak-hype pricing if volumes crater once binary political events resolve.

If October’s pattern holds, with weak retail, rotating institutions, concentrated infrastructure bets, the winners won’t be the projects that capture speculative frenzy but the platforms that become utility layers institutions can’t avoid.

The post TradFi invests over $5B into crypto firms even while Bitcoin declines appeared first on CryptoSlate.