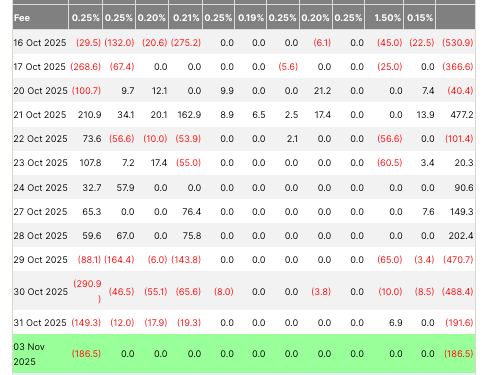

Spot Bitcoin ETFs opened the week with -$186.5 million in net redemptions on Monday, Nov. 3, stretching a four-session drain to roughly -$1.34 billion since Oct. 29. This run shows how quickly flows can swing when a single mega-issuer turns into a seller.

Data from Farside shows Monday’s outflows were effectively concentrated at IBIT, with peers essentially flat, following last week’s sequence of -$470.7 million (Oct. 29), -$488.4 million (Oct. 30), and -$191.6 million (Oct. 31).

The issuer split matters: on Friday, GBTC actually posted a small inflow of $6.9 million, even as the group bled, highlighting dispersion beneath the aggregate headline. One of the main takeaways from this distribution of outflows isn’t their size, but their composition and pace, both of which help explain why the daily totals can look volatile without necessarily signaling a broad investor exit from spot BTC exposure.

Weekly data from CoinShares shows digital asset ETPs saw net outflows of ~$360 million in the most recent week, with Bitcoin products bearing the brunt at -$946 million, while Solana funds drew ~$421 million of inflows, the second-largest on record, helped by the launch of new US SOL ETFs. In other words, it appears that investor appetite shifted to other ETPs.

The same report links the week’s bias to the market’s hawkish read of Chair Powell’s comments following a recent rate cut, an interpretation that kept risk markets cautious and left flows skittish at the margin. Taken together, the cross-asset split (BTC out / SOL in) and the policy narrative suggest a repositioning, rather than a wholesale abandonment, of crypto ETPs.

When analyzing ETF flows, it is essential to remember that flows don’t equal price, and daily prints don’t always reflect trends. Spot Bitcoin ETF flows comprise net creations and redemptions reported by issuers and compiled by independent trackers, such as Farside. They’re certainly among the cleanest real-time signals of US demand for wrapped BTC exposure. Still, they can also be distorted by issuer-specific activities, such as AP inventory management, creation basket timing, or even a single fund’s model-driven rebalancing.

That’s why Monday’s IBIT outflows can move the total even when others are flat. And because updates are typically released in the evenings US time, the flow data can lag or bunch, creating streaks that could be a result of reporting cadence rather than sentiment change.

That’s why looking at multi-day sums and issuer dispersion is the more reliable tell of trends in the ETF market.

The approximately $1.34 billion outflow we’ve seen over the past four trading days is undoubtedly substantial. However, it follows months of historically large two-way prints and sits alongside large inflows into non-BTC segments, such as Solana ETFs. Looking through the macro lens, this pattern resembles tactical de-risking into policy and price uncertainty rather than large structural outflows.

In the coming days and weeks, the market will be watching to see whether IBIT’s selling pressure persists or shifts to other issuers. A significant development will also be whether the SOL inflow streak fades as the new product settles. Any break in the daily outflow streak will also signal stabilization.

If flows stabilize or turn green while Bitcoin maintains support at $110,000, we can safely say that last week’s outflow streak was positioning noise rather than a turn in demand. However, another week of $1 billion or more in outflows, concentrated in one or two issuers, would indicate that large allocators are actively reducing risk in their flagship funds. Either way, the current story is dispersion and rotation, with no inevitable capitulation yet.

The post Why Bitcoin ETFs started to bleed out as four-day outflows hit $1.34B appeared first on CryptoSlate.