Spot Bitcoin ETFs saw a sharp $566.4 million outflow on Tuesday, Nov. 4, extending its five-day drain to roughly $1.9 billion and decisively flipping the week’s tone into risk-off.

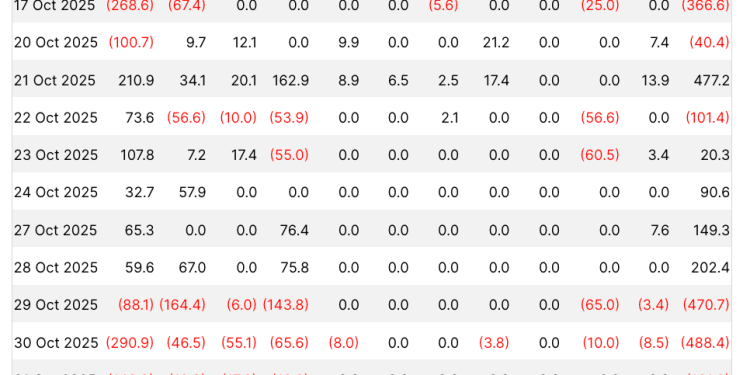

Fidelity’s FBTC accounted for the majority of the exits at -$356.6 million, with ARKB at -$128.1 million and Grayscale’s GBTC at -$48.9 million. No fund posted an inflow.

This is the largest single-day outflow since Aug. 1, a fresh new high for redemptions in the second half of the year. The rolling five-day tally is now near $1.9 billion.

Bitcoin’s price action offered little cushioning to the ETF market. Bitcoin briefly dipped below the coveted $100,000 level on major US exchanges on Tuesday before stabilizing just above $100,000 into Wednesday morning. Aggregated data puts Bitcoin’s average price on Nov. 4 at $101,475, with the early hours of Nov. 5 bringing little upside to the price.

Yesterday’s outflow was concentrated at Fidelity’s FBTC, while ARKB and GBTC added notable, but significantly smaller redemptions. It’s a noteworthy change from Monday outflows, where BlackRock’s IBIT accounted for almost all of the outflows.

The setup that leads into the second half of the week is now pretty straightforward. With Bitcoin struggling to find stability at $100,000 and realized volatility increasing, the next ETF print will have a significant impact on near-term sentiment. Another significant redemption in the next two to three days would reinforce the idea that de-risking is now being expressed through the largest and most liquid wrappers. It will take more than a single day of net creations to reverse this risk-off sentiment.

When analyzing the macro context behind ETF flows, it’s important to focus on the classic feedback loop: flows influence AP’s hedging and inventory, which then influences spot liquidity, which then influences derivatives positioning and funding. That loop can easily loosen or tighten within a couple of trading days.

Given the scale and concentration of Tuesday’s outflows, we’ll be carefully watching FBTC’s next print, the persistence of GBTC’s outflows, and whether ARKB’s redemptions continue in size. If the streak breaks, and we see a large fund like IBIT posting inflows again, there’s a good chance Bitcoin’s price will be able to find support above $100,000. If these outflows extend, the market will have to absorb a new wave of selling pressure at a time when both liquidity and confidence are already in short supply.

The post Spot BTC ETFs fail to sure up Bitcoin decline as outflow streak hits $1.9B appeared first on CryptoSlate.