The consensus that Bitcoin has matured into “digital gold” faces a new fracture line on Wall Street, one that has little to do with daily price volatility and everything to do with the distant future of computing.

Two prominent strategists named Wood are currently offering diametrically opposed roadmaps to global allocators for the world’s largest crypto asset.

On Jan. 16, Christopher Wood of Jefferies eliminated his firm’s long-standing Bitcoin exposure, citing the existential threat posed by quantum computing.

On the other hand, Cathie Wood of ARK Invest is urging investors to look past technical anxieties and focus on the asset’s distinct lack of correlation with traditional markets.

This divergence highlights a critical evolution in how institutional capital is underwriting crypto assets in 2026. The debate is no longer merely about whether Bitcoin is a speculative token or a store of value.

It has shifted toward a more complex calculation regarding survivability, governance, and the specific type of hedge investors believe they are buying.

The quantum exit

Christopher Wood, the global head of equity strategy at Jefferies, built a reputation for navigating market sentiment with his “Greed & Fear” newsletter.

His latest move cuts against the grain of two years of institutional accumulation by removing a 10% Bitcoin allocation from his model portfolio entirely.

In the reallocation, Jefferies shifted the 10% Bitcoin sleeve into assets with older narratives: 5% into physical gold and 5% into gold-mining stocks.

The rationale is rooted in tail risk rather than immediate market dynamics. Wood argued that advances in quantum computing could eventually undermine the cryptography that secures the Bitcoin network.

While most investors still file quantum threats under “science projects,” Jefferies is treating the possibility as a disqualifying factor for pension-style, long-horizon capital.

This anxiety is finding validation among technical experts who argue the timeline for a threat is compressing faster than markets realize.

Charles Edwards, founder of Capriole, argued that a quantum computer could break Bitcoin in just 2 to 9 years without an upgrade, with a high probability in the 4- to 5-year range.

Edwards describes the market as having entered a “Quantum Event Horizon,” a critical threshold at which the frontier risk of a hack is roughly equal to the time required to reach upgrade consensus and execute a rollout.

In the Jefferies framing, the uncomfortable reality is that a quantum computer will someday be able to crack Bitcoin because its security assumptions rest on cryptographic primitives that are vulnerable to those powerful future machines.

The specific threat involves adversaries “harvesting” exposed public keys now to store them and decrypt the private keys later when hardware matures.

Estimates suggest more than 4 million BTC are held in vulnerable addresses due to reuse or older formats. This leaves a “harvest now, decrypt later” attack vector that could compromise a massive share of the total supply.

Quantum computing is not an immediate Bitcoin threat

Grayscale, one of the largest digital-asset managers, has sought to ground the 2026 market conversation by labeling quantum vulnerability a “red herring” for this year.

Its analysis suggests that, while the threat is real, it is unlikely to drive prices in the near term.

Considering this, Grayscale argued that in the longer run, most blockchains and much of the broader economy will need post-quantum upgrades anyway.

This view aligns with developments within the crypto sector.

Andre Dragosch, Bitwise Europe’s Head of Research, has also countered the “immediate doom” narrative by emphasizing the sheer computational gulf between current technology and a viable attack.

While Dragosch validated concerns about older wallets, he argues that the network itself remains extraordinarily robust.

He wrote:

“Bitcoin now runs at 1 zeta hash per second, equivalent to more than one million El Capitan-class supercomputers. That’s orders of magnitude beyond the reach of today’s quantum machines – and even beyond those expected in the foreseeable future.”

The case for Bitcoin

Considering the above, ARK Invest is doubling down on the argument that Bitcoin belongs in modern portfolios precisely because it behaves unlike anything else.

In a 2026 outlook note, ARK’s Cathie Wood leaned on correlations rather than ideology.

Her argument is clinical: Bitcoin’s return stream has remained weakly linked to major asset classes since 2020, therefore offering a way to improve portfolio efficiency.

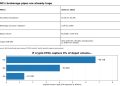

ARK supported this view with a correlation matrix using weekly returns from January 2020 through January 2026. The data shows Bitcoin’s correlation with gold at 0.14 and with bonds at 0.06.

Perhaps most strikingly, the table shows that the S&P 500’s correlation with bonds is higher than Bitcoin’s correlation with gold.

Wood uses this data to argue that Bitcoin should be viewed as a valuable diversifier for asset allocators seeking higher returns per unit of risk in the years ahead.

This represents a subtle but important shift in messaging. ARK is reframing Bitcoin from “a newer version of gold” into “an uncorrelated return stream with asymmetric upside.”

Redefining the hedge

For investors watching the split between two of the market’s high-profile strategists, the immediate takeaway is not that Bitcoin is broken. It is that the institutional narrative is maturing into something more demanding.

Jefferies is effectively saying that a hedge that might require a contentious protocol-level migration is not the same as physical gold, even if both assets can rally in the same macro regime.

This is because gold does not require coordination, upgrades, or governance to remain a valid asset. On the other hand, Bitcoin is a hedge that ultimately depends on its ability to adapt.

Conversely, there is a counterargument that traditional finance faces greater near-term peril from quantum computing than Bitcoin does.

Dragosch said:

“Banks depend heavily on long-lived RSA/ECC keys across authentication and interbank communications. Once quantum machines can break these, systemic attacks become possible – far earlier than any realistic threat to Bitcoin’s decentralized architecture.”

With this in mind, ARK is effectively saying that the benefits of portfolio diversification can justify a BTC position, even if the asset is still evolving.

So, the question that hangs over these cases is whether Bitcoin can credibly coordinate a post-quantum transition without splintering the social consensus that gives it monetary value.

The post Bitcoin’s “quantum” death sentence is causing a Wall Street rift, but the fix is already hidden in the code appeared first on CryptoSlate.