Ethereum’s most infamous experiment is back. Not as a venture fund, but as something the ecosystem arguably needs more: a permanent security budget.

On Jan. 29, a group of Ethereum veterans announced plans to convert roughly 75,000 ETH in decade-old recovery funds into a staked endowment whose yield will finance smart contract security work across Ethereum and its layer-2 ecosystem.

The capital comes from “edge case” funds left over from the 2016 hard fork that rescued TheDAO from collapse. Those are funds thatwere always intended, if unclaimed, to support security infrastructure.

A decade later, the tooling and threat landscape have matured enough to operationalize that intent.

The timing reveals a deeper shift. This isn’t nostalgia, but recognition that Ethereum’s security capacity must scale like an institution if the network wants to underpin global finance.

The pool has grown from millions to nine figures while sitting largely dormant, and the ecosystem finally has the operational primitives to steward it responsibly. What changed wasn’t sentiment. What changed was the risk calculus.

What TheDAO will become

TheDAO Security Fund will steward approximately 70,500 ETH from the ExtraBalance withdrawal contract and roughly 4,600 ETH in the Curator Multisig.

The fund explicitly will not touch ETH inside the main WithdrawDAO contract created by the hard fork. DAO tokens remain redeemable for ETH, and that recovery mechanism stays intact.

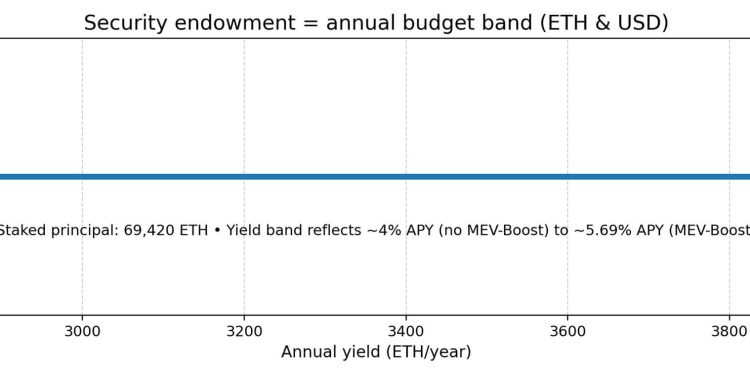

The deployment plan treats the capital as an endowment. The fund will stake 69,420 ETH to generate yield, leaving some ETH in ExtraBalance so claims can continue.

Staking operations will run through Dappnode, distributed across six continents, using multiple client implementations and distributed validator keys across several shards.

Even conservative validator economics imply meaningful annual capacity: at roughly 4% APY without MEV-Boost or 5.69% with it, 69,420 ETH generates approximately 2,777 to 3,950 ETH per year before operational costs. At $2,800 per ETH, that translates to roughly $7.8 million to $11.1 million annually.

This is a standing security budget that doesn’t require the sale of principal.

The fund’s scope covers wallet UX and user protection, smart contract security, incident response, and core protocol security, with a focus on Ethereum and its layer-2 ecosystem.

The Ethereum Foundation’s Trillion Dollar Security initiative provides the strategic roadmap.

Allocation mechanisms include quadratic funding, retroactive funding, and RFP-based ranked-choice voting, run in rounds by independent operators.

EF Grants Management defines eligibility requirements, Giveth supports operators, and each round ends with a public retrospective. A new curator set will steer the fund: Vitalik Buterin and Griff Green, joined by Taylor Monahan, Jordi Baylina, pcaversaccio, Alex Van de Sande, and Pol Lanski.

What happened to TheDAO

TheDAO was a 2016 on-chain venture fund concept that raised over $150 million and represented roughly 14% of the ETH supply at the time, a scale that made the subsequent exploit existential for Ethereum’s legitimacy.

An attacker drained funds through a contract vulnerability, forcing Ethereum into its defining governance moment: a hard fork to move funds into a recovery contract that token holders could use to withdraw their share.

The hard fork created the WithdrawDAO contract, enabling standard redemptions. But standard claims didn’t cover everything. A curator multisig was tasked with addressing edge cases, such as late-stage creation pricing discrepancies captured in “ExtraBalance,” child DAO burns, and miscellaneous token and ETH sends.

On Aug. 2, 2016, the curator’s communication explicitly stated that, after Jan. 31, 2017, unclaimed ETH would be sent to a not-for-profit entity to support smart contract security, or burned if no such fund existed.

That line is now the moral backbone of the 2026 revival.

TheDAO also became a landmark in US regulation. The SEC’s 2017 investigative report concluded that DAO tokens were securities under federal law using a facts-and-circumstances analysis, cementing TheDAO as a recurring reference point in “what is a security?” debates.

The brand carries regulatory baggage, which makes its repurposing as a security-funding mechanism ironic.

Why now, and what it means

The spark came from security practitioners, not market opportunists.

In August 2025, SEAL 911 explored sustainable funding sources for incident response. Fade from Wintermute pointed out the edge-case funds, leading to outreach via pcaversaccio to Griff Green.

The curator noted that the system was designed to manage roughly $6 million but now holds approximately 75,000 ETH, which is over $200 million at current prices. Doing nothing had become a material security liability.

The ecosystem has better primitives now. The contracts are a decade old, built when Solidity was young. Multisig practices and security frameworks have matured dramatically, exactly the operational upgrade that SEAL’s multisig frameworks and distributed validator techniques formalize today.

The Ethereum Foundation’s Trillion Dollar Security initiative sets the ambition: Ethereum must achieve “civilization-scale” security to underpin global finance. TheDAO Security Fund explicitly plugs into that roadmap, converting a historical artifact into infrastructure.

What it means for Ethereum is structural. Security funding can shift from episodic grants triggered by incidents to an endowment model that plans multi-year programs, including incident response capacity, formal verification pipelines, and wallet UX hardening.

The fund becomes a live testbed for how security public goods get priced and selected, running allocation experiments with transparent retrospectives.

If these mechanisms work, they could become templates for other ecosystems.

TheDAO’s brand is being repurposed to reframe Ethereum’s origin story. In 2016, TheDAO forced Ethereum to reveal its social layer, and the community chose to fork and recover funds rather than treat “code is law” as absolute.

In 2026, that same saga becomes a demonstration that social consensus didn’t just bail out users. Instead, it created a decade-long recovery apparatus that can now underwrite security for the entire ecosystem.

The deeper narrative thread connects Ethereum’s legitimacy crisis to its institutional maturation: the hard fork that critics called centralized becomes the funding mechanism for decentralized security infrastructure.

There’s a latent controversy vector. Even with documented intent, “using leftovers” invites scrutiny. Are claims truly exhausted or just dormant? How will edge-case claims get adjudicated going forward? Does this create governance precedent for other recovery pools?

The fund addresses part of this by leaving claim paths open in ExtraBalance and avoiding the main withdrawal contract, but these questions remain live.

If disputes arise over claim eligibility or curator legitimacy, or if an operational incident affects the multisig or validator setup, the narrative could shift from “security endowment” back to “the DAO controversy returns.”

Three forward paths

The base case looks like security funding becoming a permanent line item.

If 69,420 ETH stays staked with steady validator yield, and regular grant rounds produce transparent retrospectives that show a measurable pipeline from Trillion Dollar Security priorities to funded work, Ethereum’s security capacity scales more like an institution.

This improves confidence for larger on-chain balances and mainstream UX, making security part of the “why build here” story.

The bull case sees security funding become a competitive moat. If yield is strong or ETH price rises, and the annual budget expands materially and grants a meaningful increase in professional incident response and tooling, Ethereum’s L2 ecosystem might adopt similar endowment patterns.

Security becomes part of Ethereum’s institutional-readiness narrative, much as exchanges and custodians sell trust.

In the adverse case, governance or operational risk dominates the headline. Disputes over claim eligibility, an operational incident involving the multisig or validator setup, or regulatory narratives that revive “DAO token = security” baggage could chill perception, even if funds remain safe. The story shifts from endowment back to controversy.

| Scenario | What you’d see on-chain / operationally | What it means for Ethereum | Primary risks |

|---|---|---|---|

| Base case: Permanent security line item | 69,420 ETH remains staked (steady validator ops); regular grant rounds with published retrospectives; clear linkage of funded work to EF Trillion Dollar Security (1TS) priorities; predictable cadence + reporting | Security funding shifts from episodic “post-incident” grants to an institutional-grade, multi-year budget (incident response capacity, formal verification pipelines, wallet UX hardening); improves confidence for larger on-chain balances and mainstream UX | Governance drift (mission creep, weak accountability); grant capture (insiders/low-ROI spend); operational complacency over time |

| Bull case: Security becomes a moat | Favorable yield regime and/or higher ETH price expands annual budget; measurable security outcomes (fewer/severity-reduced incidents, better tooling, faster response); L2s mirror the endowment pattern; allocation mechanisms iterate and improve based on retrospectives | Ethereum earns a “why build here” trust premium; security becomes a competitive moat vs other ecosystems; the model becomes a template for funding security public goods elsewhere | Overreach (fund tries to do too much); incentives misaligned with user outcomes (metrics theater); political friction between ecosystem stakeholders over priorities |

| Adverse case: Controversy dominates | Public disputes over claim eligibility/legitimacy of “edge-case” funds; multisig/validator incident or operational failure; renewed attention to regulatory baggage (DAO-as-security narratives); stalled or chaotic grant rounds | Narrative flips from “security endowment” to “the DAO controversy returns,” chilling perception even if funds remain safe; governance becomes the headline instead of security outcomes | Governance legitimacy risk (who decides, why them?); operational security risk (key management, validator setup); reputational/regulatory amplification of any misstep |

For now, it is up to watch on-chain balances of ExtraBalance, the Curator multisig, and WithdrawDAO to track how much gets staked versus left for claims.

Other metrics to monitor include staking yield regime shifts to estimate annual security budget size, grant-round design, and retrospectives to assess whether allocation improves, and alignment with Ethereum Foundation priorities to see if funds go where the EF identifies the biggest security return on investment.

TheDAO’s return isn’t a second act. It is the conversion of Ethereum’s most painful lesson into its most durable security infrastructure.

The post TheDAO’s leftover rescue money sat for a decade now it’s becoming Ethereum’s permanent $220M security budget appeared first on CryptoSlate.