The post Bitcoin Price Crash Continues as Analysts Weigh BTC Bottom Timing appeared first on Coinpedia Fintech News

The Bitcoin price is under pressure after slipping below its April 2025 low. The move has reignited fears of a deeper correction, but analysts remain divided on whether this is the final phase of the bear market or just another leg down before recovery.

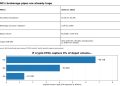

Historically, Bitcoin bear markets last around 12 months. Considering this, the current cycle appears roughly one-third complete. However, this time the decline has been faster than usual, raising the possibility that the bottom could arrive earlier than in past cycles.

Bitcoin Market Cycle Appears to Be Moving Faster

One key difference in this cycle is speed. Bitcoin topped earlier than expected in October, and the decline since then has been sharper than previous bear markets. Some analysts believe this faster drop could mean the bottom also forms sooner, possibly between June and August instead of late Q4.

There is also a growing belief that Bitcoin market cycles are shortening overall. As institutional participation increases, long-term holders and miners may have less influence on price swings, slowly pushing Bitcoin toward behavior closer to traditional risk assets like the S&P 500.

How Low Can Bitcoin Price Crash?

Based on historical drawdowns, Bitcoin often finds strong buying interest after falling 40% to 60% from its peak. In this cycle, many analysts do not expect a 70% crash like earlier bear markets.

Current estimates suggest Bitcoin may be 20% to 30% away from the final bottom. If price continues lower, the $65,000 level is seen as a zone where fear typically builds. A deeper drop toward $55,000 could trigger panic selling.

So, Late Q3 or early Q4 could offer better conditions for long-term investors to re-enter the market with confidence. Using the traditional 365-day bear market model, there are roughly 200 days left before a formal bottom forms.

From here, Bitcoin may move sideways with slow weakness, or it could drop sharply, bringing the bear phase to an earlier end.

Bitcoin Below Long-Term Support Raises Risk

Veteran trader Peter Brandt has noted that Bitcoin has breached an important long-term support level on the weekly chart. Historically, when this happens, the price often moves lower before finding real stability.

Past cycles in 2014, 2018, and 2022 show that once Bitcoin fell below the 100-week moving average, it often dropped quickly toward the 200-week level before any meaningful bounce occurred. This history suggests that short-term relief rallies are not guaranteed.

.article-inside-link {

margin-left: 0 !important;

border: 1px solid #0052CC4D;

border-left: 0;

border-right: 0;

padding: 10px 0;

text-align: left;

}

.entry ul.article-inside-link li {

font-size: 14px;

line-height: 21px;

font-weight: 600;

list-style-type: none;

margin-bottom: 0;

display: inline-block;

}

.entry ul.article-inside-link li:last-child {

display: none;

}

- Also Read :

- CoinRoutes Co-Founder Alleges “Coordinated” Manipulation Behind October Crypto Crash

- ,

Galaxy CEO Says Bitcoin Is Near the Lower End of a New Range

Galaxy Digital CEO Mike Novogratz believes Bitcoin’s recent drop is driven by profit-taking rather than a breakdown in fundamentals. After Bitcoin surged above $100,000 and later reached near $130,000, many early investors locked in gains, creating selling pressure.

According to Novogratz, Bitcoin may now be trading within a broad $70,000 to $100,000 range. With price hovering near $76,000, he believes much of the excess leverage has already been flushed out, bringing the market closer to balance.

Further, macro conditions may play a role in stabilizing the Bitcoin price. The progress on crypto market structure regulation and shifts in interest rate expectations could improve sentiment.

Novogratz also highlighted that stablecoin usage and blockchain infrastructure growth remain strong, suggesting adoption continues even as prices struggle.

FAQs

Analysts see strong demand between $65,000 and $55,000, a range where fear peaks and long-term buyers often step back in.

Higher institutional activity and faster capital flows are shortening cycles, making price drops sharper but potentially reducing bear market length.

If history repeats, Bitcoin may stabilize by late Q3 or early Q4 as selling slows and macro conditions improve.