The post China Orders Banks to Cut U.S. Treasury Holdings: Is This Bullish for Bitcoin and Crypto? appeared first on Coinpedia Fintech News

China has ordered major banks to reduce their U.S. Treasury holdings, signaling a major shift in global finance. The move reflects rising concerns over U.S. debt risks and market volatility

Experts believe that this decision could create new opportunities for Bitcoin and the overall crypto market.

China Orders Banks to Reduce U.S. Bond Exposure

Reports suggest that Chinese regulators have warned banks about “concentration risks” and rising volatility in U.S. Treasuries. Financial institutions have been advised to reduce oversized positions and limit further purchases.

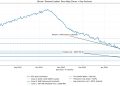

China’s holdings of U.S. Treasuries have already been falling for years. Official data shows that the country now holds around $682.6 billion in Treasuries, the lowest level in 17 years and far below its peak of $1.3 trillion a decade ago.

Over the past 14 years, China has reduced more than $500 billion in U.S. debt while steadily increasing its gold reserves.

In fact, Beijing has been buying gold for 18 months in a row, showing a clear preference for hard assets over government bonds.

.article-inside-link {

margin-left: 0 !important;

border: 1px solid #0052CC4D;

border-left: 0;

border-right: 0;

padding: 10px 0;

text-align: left;

}

.entry ul.article-inside-link li {

font-size: 14px;

line-height: 21px;

font-weight: 600;

list-style-type: none;

margin-bottom: 0;

display: inline-block;

}

.entry ul.article-inside-link li:last-child {

display: none;

}

- Also Read :

- Top Crypto Market Events to Watch This Week: CPI, Fed Speakers, and Jobs Data

- ,

China’s Long-Term Move Away From U.S. Debt

Importantly, this order does not affect China’s official foreign exchange reserves held by the central bank. Instead, it targets commercial banks and their growing exposure to dollar-denominated assets.

With China stepping back as one of the biggest buyers of U.S. Treasuries, the traditional support system for American bonds is weakening.

The absence of such a large buyer could lead to higher volatility in the bond market and rising interest rates.

What This Means for Bitcoin and Crypto

Investors look for safer options. In the past, gold has benefited the most from this trend. Gold prices jumped nearly 72% in a year and recently touched a record high of around $5,600. Now prices are easing as some investors book profits.

Usually, after gold peaks, investors shift part of their money into Bitcoin. This is because Bitcoin is seen as a digital store of value, similar to gold.

Right now, Bitcoin has dropped from its all-time high of $126,000 and is trading near $69,712. Many investors see this as a discounted buying level.

Other major cryptocurrencies like ETH, SOL, XRP, ADA & Doge are also down 40% to 70% from their highs. This market pullback is making crypto assets more attractive for long-term buyers.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

China sees rising U.S. debt risk and bond volatility, so it’s lowering bank exposure to avoid concentration risk and protect financial stability.

Reduced demand for U.S. debt can increase market volatility, leading investors to seek alternative stores of value, with Bitcoin often benefiting as a “digital gold” in such shifts.

No, it’s a long-term shift. China has cut over $500 billion in U.S. debt over 14 years while steadily increasing its gold reserves for greater financial security.

Market shifts can create opportunities. Some investors view Bitcoin as a hedge during traditional market volatility, but always assess your risk tolerance and research thoroughly.