The following is a guest post and analysis from Vincent Maliepaard, Marketing Director at Sentora.

A year ago, tokenized equities barely registered as an asset class. Today, the market is approaching $1 billion—a nearly 30x increase—and December 2025 may have delivered the regulatory clarity needed for institutional adoption to accelerate.

What changed? Three things: a small group of platforms moved fast to capture market share, regulators started building actual frameworks instead of issuing warnings, and traditional finance players began treating blockchain settlement as infrastructure rather than an experiment.

The Race to Scale

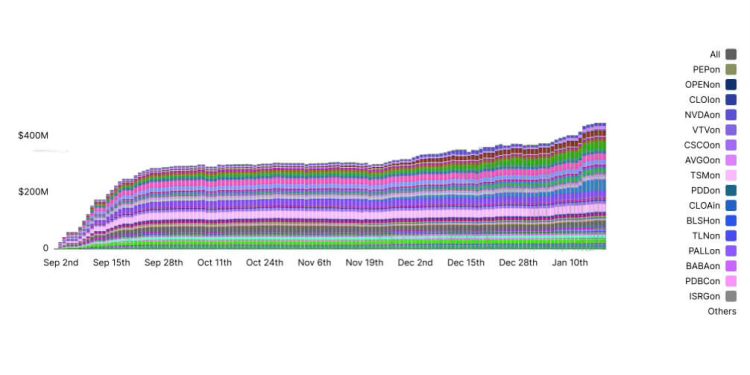

When Ondo Global Markets launched in September 2025, it became the largest tokenized stock platform within 48 hours. That kind of velocity doesn’t happen by accident; it reflects pent-up demand from investors who wanted exposure to U.S. equities through blockchain rails, particularly from outside the United States, where 24/7 market access is a meaningful advantage.

The market is now dominated by three players. Ondo holds roughly half of all tokenized equity value with 200+ assets. Backed Finance, acquired by Kraken in December 2025, controls about a quarter of the market. Securitize rounds out the top three with a single asset: Exodus, the first U.S.-registered company to tokenize its common stock. Together, these three platforms account for over 93% of the market.

| Platform | Total Value | Market Share | Assets |

|---|---|---|---|

| Ondo Global Markets | $461.6M | 53.8% | 201 |

| xStocks (Backed/Kraken) | $193.7M | 22.6% | 74 |

| Securitize | $146.6M | 17.1% | 1 |

| WisdomTree | $23.0M | 2.7% | 5 |

| Superstate Opening Bell | $18.5M | 2.2% | 3 |

| Dinari dShares | $3.1M | 0.4% | 88 |

Source: Sentora Research – Tokenized Equities

Growing Faster Than Tokenized Treasuries

Tokenized treasuries remain the larger market at $9.3 billion, but equities are growing roughly 30x faster. The divergence reflects different buyer profiles. Treasury tokenization attracted institutions seeking yield-bearing, stable value—a relatively conservative use case. Equity tokenization is capturing more speculative and access-oriented flows.

The trading patterns support this interpretation. Monthly transfer volume for tokenized equities reached $2.4 billion against roughly $860 million in assets under management—a volume-to-AUM ratio of nearly 3x. That’s active trading, not passive holding.

Where the Assets Live

Ethereum still leads with 38.5% of tokenized equity value, but its dominance is eroding. Solana has captured 18.5% as the primary chain for xStocks, benefiting from sub-second finality and integration with lending protocols like Kamino Finance. Algorand holds 15% through Exodus alone, reflecting its focus on compliant securities infrastructure rather than general-purpose DeFi.

| Chain | Tokenized Equity Value | Share |

|---|---|---|

| Ethereum | $329.8M | 38.5% |

| Solana | $158.8M | 18.5% |

| Algorand | $130.6M | 15.2% |

| BNB Chain | $33.7M | 3.9% |

| Stellar | $22.7M | 2.6% |

Source: Sentora Research – Tokenized Equities

The December Regulatory Shift

December 2025 delivered two developments that could reshape the market. First, the SEC authorized a three-year DTCC pilot enabling tokenization of Russell 1000 equities, U.S. Treasury securities, and major index ETFs. Expected to launch in H2 2026, this creates a pathway for traditional market infrastructure—central clearing, regulated exchanges, broker-dealer intermediation—to interoperate with blockchain settlement.

Second, the SEC clarified that broker-dealers can maintain custody of tokenized equities if they control private keys and implement appropriate security policies. This removes a barrier that previously complicated institutional participation. Nasdaq has also proposed trading tokenized securities on its exchange while maintaining national market system oversight.

Internationally, Ondo received approval to offer tokenized U.S. stocks across all 30 EEA countries through Liechtenstein’s regulator—a distribution channel reaching 500+ million potential investors. The SEC closed its investigation into Ondo without charges in November 2025, removing regulatory overhang.

What to Watch From Here

Tokenized equities have gone from idea to working market infrastructure in less than a year. What comes next hinges on two things: whether regulatory momentum continues, and whether traditional market infrastructure actually migrates onto blockchain rails or keeps blockchain in a separate sandbox.

Forecasts for tokenized assets span a wide range—from roughly $2 trillion to nearly $19 trillion by the early 2030s, depending on the methodology. If equities maintain their current share of tokenized real-world assets, that implies a $20 to $190 billion market by the end of this decade. Reaching that scale would require sustained 50% to 100%+ annual growth—ambitious but not inconsistent with what the category has already demonstrated over the past 12 months.

One meaningful catalyst for that growth could be tokenized stocks as usable collateral in DeFi, effectively enabling retail investors to borrow against publicly traded equity in a programmable, on-chain way.

The post Tokenized equities approach $1B as institutional rails emerge appeared first on CryptoSlate.