Bitcoin (BTC) walks to close 2025 with more than $112 billion locked in US spot ETFs, exchange reserves at a record low of 2.751 million BTC, and perpetual futures open interest of nearly $30 billion.

Every single one of those data points would have sounded constructive in 2022. In late 2025, they map to the same outcome: price chopping between $81,000 and $93,000 while narratives stay bullish and volatility stays suppressed.

The gap between what the numbers say and how the market trades defines structural stagnation. In this regime, liquidity exists but doesn’t flow, where capital is large but fragmented, and where the plumbing can’t translate headline demand into directional conviction.

The tell came on Dec. 17, when Bitcoin liquidated $120 million of shorts and $200 million of longs within hours, not because leverage exploded but because order books couldn’t absorb the round-trip without whipsawing.

Spot depth on tier-one centralized exchanges looks acceptable on paper. CoinGecko’s June 2025 report pegs the median BTC order-book depth at $20 million to $25 million on each side, within ±$100 of the mid-price across eight major venues.

Binance alone supplies roughly $8 million on bid and ask, accounting for 32% of the total. Bitget holds $4.6 million, OKX $3.7 million. Zoom in to a ±$10 band and only Binance clears $1 million on each side.

Most of the other exchanges sit between $100,000 and $500,000, with Kraken and Coinbase closer to $100,000. That’s institutional-grade depth if investors are crossing a few hundred coins.

Yet, it’s tissue paper if a medium-sized fund decides to rebalance or a macro event forces simultaneous unwinding across venues.

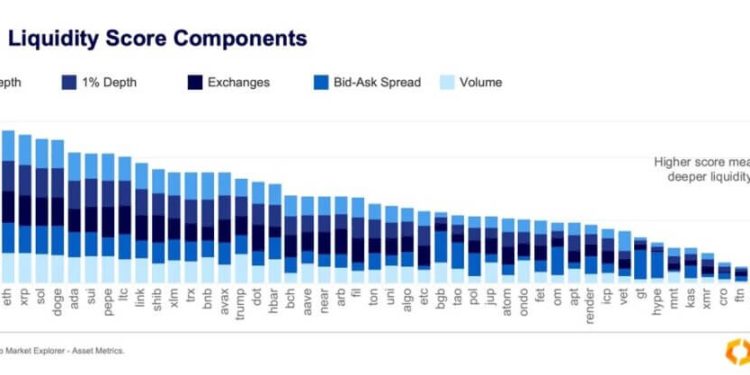

Kaiko’s February 2025 liquidity ranking confirms the asymmetry: market depth has clawed back to pre-FTX levels for Bitcoin, Ethereum, Solana, and XRP, but more than half of the top 50 tokens by market cap still fail to generate $200 million in average daily volume.

Liquidity beyond the majors decays fast, and Kaiko flags that when trading activity runs hot relative to available depth, price impact jumps non-linearly. The architecture has recovered; the capacity hasn’t scaled.

Blood-flow problem

Low exchange reserves cleanly mapped to bullish supply dynamics: fewer coins on venues meant less inventory available to sell.

That logic breaks when coins stop moving between exchanges. CryptoQuant’s Inter-Exchange Flow Pulse (IFP) has weakened throughout 2025, indicating that arbitrageurs and market makers are less active in moving Bitcoin across venues to exploit mispricings.

Lower IFP thins out the aggregate order book and makes prices more sensitive to individual orders, even small ones. When record-low reserves with weak inter-exchange circulation are combined, scarcity expresses as fragility rather than mechanical strength.

Binance complicates the picture further. While most major exchanges report net BTC outflows, Binance has recorded net inflows, concentrating tradable inventory on the single venue where price discovery happens.

That centralization blunts the “low reserves equals bullish” framing, because sellable supply is pooling exactly where liquidity matters most.

If depth is shallow everywhere else and concentrated on one platform, any large flow, whether ETF redemption, macro-driven selling, or derivatives unwind, hits the same choke point.

Derivatives reset without conviction

Perpetual futures open interest dropped from cycle highs near $50 billion to roughly $28 billion by mid-December, per Glassnode’s recent report. That’s a near-50% drawdown in the market’s ability to absorb directional bets.

Funding rates hovered near the 0.01% baseline during the recent selloff, rather than spiking either way, and Binance’s late-October funding note shows BTC and major alt perps sitting close to neutral with minimal deviation.

The market isn’t paying up to be long or short, as positioning has been de-risked, not re-levered.

Options positioning layers in a second constraint. The same Glassnode report pointed to Bitcoin running into a “hidden supply wall” between $93,000 and $120,000, where the short-term holder cost basis sits around $101,500 and roughly 6.7 million BTC, 23.7% of circulating supply, trades underwater.

About 360,000 BTC of recent selling came from holders realizing losses. That loss-bearing supply migrates into the long-term holder cohort, which historically precedes either capitulation or extended range-bound chop.

Dec. 26 marks the year’s largest options expiry, with heavy gamma positioning pinning the spot price in an $81,000-$93,000 range until those contracts roll off. Derivatives aren’t driving volatility, but rather suppressing it.

ETF flows as noise, not signal

US spot Bitcoin ETFs hold roughly 1.3 million BTC, about 6.5% of the market cap, and cumulative net inflows sit at $57.5 billion as of Dec. 18, per Farside Investors data.

That makes the ETF channel structurally important, but not directionally reliable. December’s flow pattern was a whipsaw: Dec. 15 saw $357.6 million in net outflows, Dec. 16 another $277.2 million, and then Dec. 17 reversed with $457.3 million in net inflows, led by Fidelity’s FBTC and BlackRock’s IBIT.

On Dec. 15, Bitcoin held near $87,000 even as ETFs bled more than $350 million in a single day, stressing that ETF flows are now large enough to move intraday sentiment but not consistently additive to price.

The vehicle is trading macro expectations and rate policy, not delivering a steady “up only” impulse.

What stagnation looks like in Q1 2026

Structural stagnation isn’t a bearish call, but just a liquidity regime.

Spot books on top centralized exchanges have recovered to pre-FTX levels for Bitcoin. Still, close-to-mid liquidity remains in the low single-digit millions per side on most venues and is overwhelmingly concentrated on Binance.

On-exchange reserves sit at record lows, but inter-exchange flows have collapsed, so thin books translate to jumpier slippage and larger price impact for the same notional.

Perpetual open interest reset, funding stays neutral, and options plus overhead spot supply between $93,000 and $120,000 mechanically pin Bitcoin into a range until new capital or a macro catalyst forces repositioning.

ETF flows swing by hundreds of millions of dollars day to day, but the sign flips on rate data, employment prints, and Fed guidance rather than crypto-native fundamentals.

Unless one of three things changes, Bitcoin can have bullish headlines, new products, and expanding infrastructure while price action remains choppy and range-bound through the first half of 2026.

Liquidity exists, but it’s stuck. The infrastructure is institutional-grade, but it’s not scale-ready. The capital is large, but it’s fragmented across venues, wrappers, and jurisdictions.

That’s what structural stagnation means: not broken, not bearish, just boxed in by its own plumbing until something forces the next leg.

The post Bitcoin metrics signal a breakout, but a massive “underwater” supply wall is secretly pinning prices below $93,000 appeared first on CryptoSlate.