Crypto markets started this new week with a surge powered by a rare alignment of favorable macroeconomic shifts.

According to CryptoSlate data, Bitcoin climbed to a fresh intraday high above $116,000 before stabilizing near $115,587 as of press time. Notably, this is its highest price level in weeks and shows that it is within sight of its prior record.

Ethereum tracked the move, pushing toward $4,200, while Solana rose past the $200 level. Other top digital assets like BNB, Cardano, Chainlink, and Hyperliquid also registered significant gains in the reporting period.

The synchronized uptrend signaled renewed momentum after several sessions of exhaustion and consolidation across major altcoins.

Why Bitcoin price rose

On-chain indicators suggest that the rally was not merely speculative.

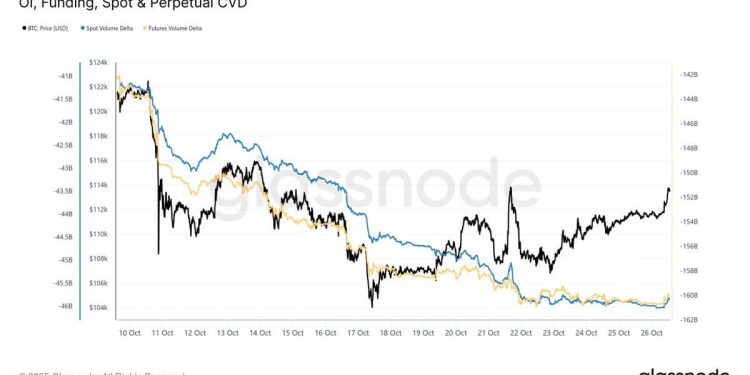

Data from Glassnode shows that, for the first time since the October 10 sell-off, spot and futures cumulative volume delta (CVD) have flattened. This shift indicates that aggressive selling pressure has finally eased after nearly two weeks of capitulation.

At the same time, funding rates remain below the neutral 0.01% threshold, indicating that traders are not excessively leveraged to the upside. In fact, funding briefly dipped into negative territory several times over the past two weeks, reflecting a cautious market still recovering from its recent shakeout.

Short-dated option skews also reveal that sentiment reached highly negative levels just before the uptrend began, a dynamic that often precedes sharp reversals.

Macro signs favor Bitcoin

Timothy Misir, head of research at BRN, told CryptoSlate that macro headlines “did the heavy lifting” of BTC’s current rise.

According to him, reports of progress toward a US–China trade framework and signs of a softer Fed stance narrowed risk premia and encouraged capital rotation into crypto.

The resulting rally, he explained, has become “highly headline-dependent,” where good news triggers outsized squeezes and any policy backtrack could quickly unwind gains.

Meanwhile, Misir pointed out that the rebound also triggered widespread liquidations across derivatives markets.

Data from Coinglass shows that roughly $365 million in short positions were wiped out within hours, affecting over 100,000 traders. Bitcoin shorts alone accounted for nearly $174 million of those losses.

Considering this, Misir noted that this combination of macro easing and forced short covering created a “short, sharp risk-on leg.”

Notably, institutional buyers, particularly ETFs, corporate treasuries, and mid-sized whales, absorbed the sell-side supply and helped sustain the upward momentum. Still, he cautioned that the market’s structure remains fragile, with options and futures positioning leaving the front end vulnerable to headline volatility.

Misir concluded:

“Treat any break above $116,000 as a potential liquidity magnet (and any failure below $108,500 as a tactical sell signal).”

The post Bitcoin rally smashes past $116k on softer Fed bets: What changes next? appeared first on CryptoSlate.