Bitcoin’s June 26 options expiry provides a clean snapshot of how risk is being framed several months out, and the picture that emerges is one of deliberate insurance.

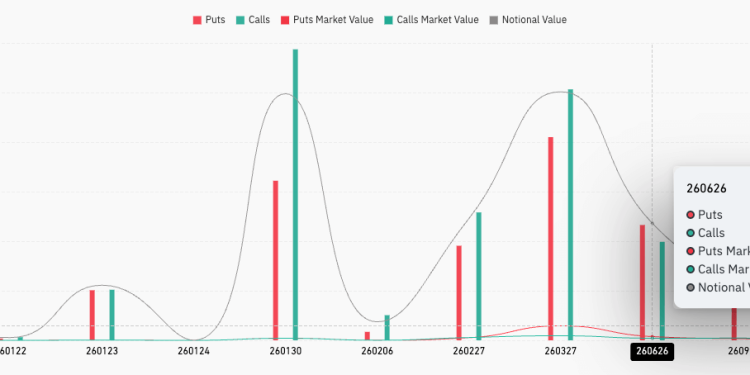

Total open interest for the expiry sits near $3.92 billion in notional terms as of Jan. 20, with puts outnumbering calls at roughly 23.28K versus 19.87K contracts. That imbalance, on its own, doesn’t imply a directional bet, but it does show that protection demand has rebuilt in a visible, measurable way.

The structure of that protection is concentrated rather than diffuse. Put open interest clusters heavily between $75,000 and $85,000, accounting for roughly one-fifth of all puts tied to the expiry. The largest single concentration sits at $85,000, followed closely by $75,000 and $80,000.

The data here clearly shows this isn’t deep tail insurance positioned far below the market. It reflects hedging bands that sit close enough to spot to matter for portfolio risk and close enough that they can be maintained without paying extreme volatility premiums.

Calls remain present across the chain, particularly above $120,000 and $130,000, with additional positioning further out.

That mix suggests upside exposure hasn’t disappeared. Instead, Deribit’s book shows a market that continues to hold upside convexity while layering downside insurance closer to spot, a pattern consistent with structured positioning rather than outright bearish conviction.

Where the market’s reference price sits

The most important reference point in the chain is the at-the-money zone, because it acts as the anchor for how probabilities and payoffs are calculated. In the Deribit data, the strike closest to a neutral delta sits around $95,000, with the $95,000 call carrying a delta just above 0.52 and the corresponding put just below -0.48.

That alignment places the market’s forward reference for the June expiry in the mid-$90,000s.

Put simply, this is the price level the options market is treating as the most neutral outcome for that date. It’s the point around which traders are deciding how much upside exposure to keep and how much downside insurance to buy.

When probabilities are quoted, they’re calculated relative to this reference level rather than the current spot price.

From that anchor, the downside structure becomes clearer. The dense positioning below $85,000 is the zone where traders are most willing to pay for protection if Bitcoin trades lower between now and late June.

Volatility looks calm, but protection is still expensive

At first glance, implied volatility (IV) doesn’t look stretched. Near the $95,000 at-the-money (ATM) strike, implied volatility for the June expiry sits in the low-to-mid 40% range, which aligns with the broader compression visible across BTC’s longer-term ATM volatility history.

Compared to previous periods of market stress, this is a relatively subdued volatility environment.

This means the market is not pricing large, constant swings in Bitcoin’s price. Volatility levels show traders are expecting controlled price action, rather than disorderly.

However, that calm doesn’t apply evenly across the options surface.

Downside protection trades at a clear premium to upside exposure. When comparable deltas are examined, puts carry several points more implied volatility than equivalent calls.

This negative skew shows that traders are currently willing to pay more to insure against declines than to position for upside. Premium data further confirms this, with put market value for the June expiry far exceeding call market value.

That asymmetry is also how Derive.xyz, an on-chain options platform, frames the setup. Its head of research, Dr. Sean Dawson, described a market where volatility has compressed even as downside insurance remains in demand.

“Options markets show a clear downside skew, with a 30% chance BTC falls below $80,000 by June 26, compared to a 19% chance it rallies above $120,000 over the same period,” he told CryptoSlate.

That figure reflects pricing mechanics rather than conviction, but it’s directionally consistent with how the surface is tilted.

The Greek profile around this expiry explains why the mid-$90,000s region matters mechanically. Vega, theta, and gamma all peak near the ATM zone, which means changes in volatility, time decay, and hedging flows are most sensitive there.

Price can feel mechanically stable near that level, then behave differently once it drifts toward the heavy downside hedge zone or accelerates above major call strikes.

The broader takeaway here is structural rather than predictive. The June 26 expiry shows a market anchored around $95,000, with concentrated insurance between $75,000 and $85,000 and persistent upside exposure above $120,000.

Volatility levels alone understate that asymmetry, but skew and open interest make it visible.

The options market isn’t panicking, but it’s clearly allocating capital to defend against a defined range of downside outcomes into mid-year.

The post Bitcoin traders are dumping billions into insurance in case the price drops to $75k as June options expiry creates a high-stakes price trap appeared first on CryptoSlate.