Bitcoin is showing the kind of fatigue that typically precedes larger directional moves.

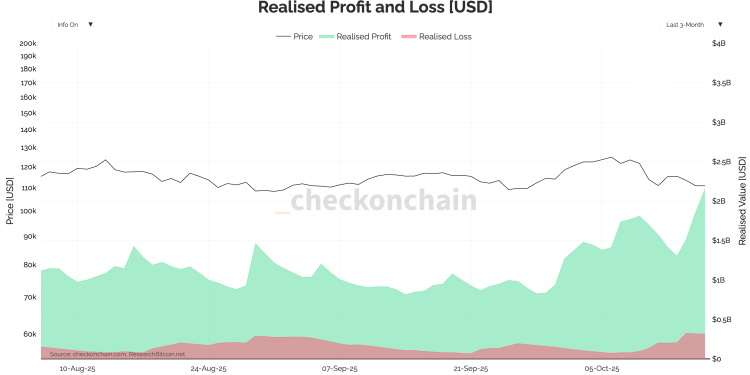

On Oct. 15, traders locked in $1.8 billion in profit, one of the heaviest cash-out days since the beginning of the summer.

Another $430 million in realized losses hit the market the same day, confirming what everyone’s been feeling since the weekend crash: momentum is getting shot, and much of the money is heading for the exit.

As of press time, Bitcoin is sitting below $110,000, down over 10% since the beginning of October. Most of that loss isn’t a slow bleed, but the fast unwind of the same holders that bought in early 2025 and held since.

Long-term holders (i.e. coins older than three months) were responsible for most of the selling, realizing over six times as much profit as short-term holders.

Since long-term holders have remained deep in the green even during last week’s crash, we can assume they’re not panicking. They’re de-risking, taking profits off the table into weakness instead of waiting for a bounce.

Some degree of profit-taking is routine after a consolidation. You can explain a few billion-dollar profit-taking days as healthy rotation. But when that flow becomes consistent, like we’ve seen since the beginning of the month, it stops looking like distribution and starts to look like exhaustion.

The realized loss side is picking up, too. While the losses are still in the “manageable” range, they have been climbing alongside profits. If realized losses continue rising alongside profits, it could indicate that the de-risking is spreading from short-term holders to the rest of the market.

This could prove to be highly contagious, as half of Bitcoin’s short-term holders are currently underwater. Data from Checkonchain shows that unrealized losses currently account for roughly 2% of the market cap, small but rising fast.

A dip below $100,000 could easily push that number to 5%, enough to turn the current discomfort into full-blown fear.

Historically, only full-blown bear phases have seen more than 30% of the supply in loss, and we’re dangerously near that threshold.

If buyers manage to defend $100,000, Bitcoin could reset its short-term cost basis and restore bullish momentum.

Below $100,000, the cost basis of the new wave of buyers collapses, and the entire short-term supply flips to loss. That wouldn’t necessarily mark the end of the cycle but could extend the correction well into $80,000, reaching a roughly 35% drawdown from the ATH.

For now, Bitcoin is still impressively stable, considering the size of the sell-side pressure. But the message on the chain is unmistakable: conviction’s thinning.

The bulls are still defending, but every candle lower makes it harder to tell if they’re buying dips or catching knives.

The post Can Bitcoin hold the line as $1.8B in realized profits hits the market? appeared first on CryptoSlate.