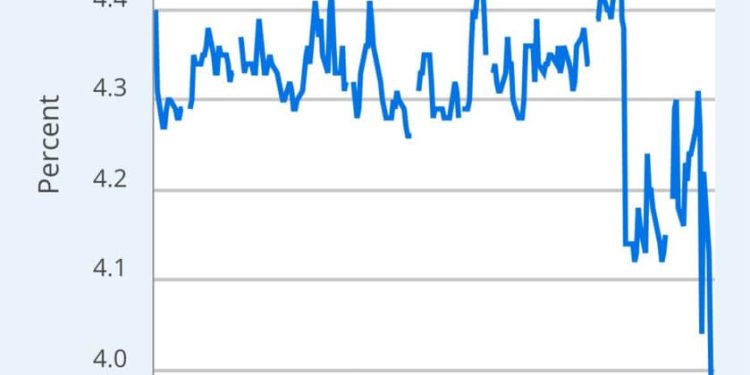

The Secured Overnight Financing Rate (SOFR) just fell off a cliff. For most people outside financial circles, that means absolutely nothing. For markets, it’s seismic.

Borrowing money overnight in U.S. markets suddenly got much cheaper. And in the plumbing of the global financial system, that’s the equivalent of someone opening the floodgates a little wider.

A falling SOFR looks good on paper.

On paper, this appears to be a win for liquidity. Cheaper short-term financing suggests that banks can breathe easier, businesses can roll credit more affordably, and risk appetite can expand again. That’s historically good news for risk-on assets like Bitcoin and crypto.

But as analysis from End Game Macro points out, this isn’t just another statistical blip. The financial system quietly adjusted itself, and not by coincidence.

When the cost of borrowing against Treasuries drops this quickly, “it usually means there’s too much cash and not enough collateral, money chasing safety.” That imbalance doesn’t appear out of nowhere. It often stems from Treasury spending surges or institutions front-running a policy shift that has not yet been made public.

In simple terms? Liquidity got cheaper not because risk declined, but because someone (or something) turned the tap back on.

The quiet stimulus

Liquidity waves like this have a history of jolting risk assets higher. As End Game Macro points out, the same mechanics that helped soothe repo markets in 2019 and kept credit flowing after the 2023 bank failures are back in motion.

With a low SOFR, treasury dealers and leveraged funds suddenly face easier financing conditions, and that relief ripples into equities, tech, and increasingly, digital assets.

Bitcoin, in particular, tends to love this kind of stealth easing. When cash is abundant and interest rates ease unexpectedly, investors shift toward assets that thrive in a liquidity-rich environment.

As Ray Dalio recently warned, when policymakers stimulate “into a bubble,” risk markets often overshoot in the short term before reality catches up.

That dynamic is unfolding again: a liquidity jolt that lifts everything, disguising fragility as strength.

Control, not stability. We’ve seen this movie before. In 2020, the system was flooded in response to a crisis. In 2023, it quietly loosened again after regional bank tremors. Each time, calm returned through intervention rather than resilience. This time is no different. The fall in SOFR gives markets a shot of calm but signals that true normalization never arrived.

For traders and asset managers, that translates to lower funding costs and a temporary window of risk-on conditions. For retirees, savers, or small businesses financed at floating rates, it serves as another reminder that yield is fleeting and prices remain policy-dependent.

The illusion holds for now.

The immediate effect is that asset prices are buoyant, credit spreads are tightening, and market sentiment is turning optimistic again. Bitcoin and other risk assets are likely to catch a bid as SOFR liquidity returns to the market. However, this isn’t organic growth; it’s a revival of leverage.

As End Game Macro concludes, liquidity hides risk; it doesn’t erase it. A system that depends on ever-larger fixes becomes numb to fundamentals. Each injection of liquidity feels good while it lasts. Markets rally, confidence builds, and the illusion feels real. Until it doesn’t.

The post Cheaper cash, higher risk as a key US funding rate suddenly collapses appeared first on CryptoSlate.