The post Crypto Regulation Kenya 2025: Parliament Passes VASP Bill to Legalize Digital Assets appeared first on Coinpedia Fintech News

Kenya’s parliament has passed the Virtual Asset Service Providers (VASP) Bill, providing the country with its first clear legal framework for cryptocurrencies. The bill now moves to President William Ruto for approval, according to Reuters.

Lawmakers believe the new legislation will bring clarity, enhance investor confidence, and stimulate growth in Kenya’s digital asset sector, which has previously faced challenges due to regulatory uncertainty.

Who Will Oversee Cryptocurrency in Kenya?

Under the new law, crypto oversight will be shared between two key authorities. The Central Bank of Kenya (CBK) will be responsible for licensing stablecoins and other virtual assets, while the Capital Markets Authority (CMA) will supervise crypto exchanges and trading platforms.

Kuria Kimani, head of the National Assembly’s finance committee, explained:

“This structure is designed to balance safety and innovation, ensuring that both investors and businesses have clear guidelines for operating in the digital asset market.”

By splitting responsibilities, Kenya aims to protect consumers while fostering innovation in the rapidly evolving crypto sector.

Kenya Hopes to Attract Global Crypto Investment and Innovation

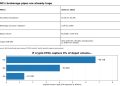

The VASP Bill is expected to position Kenya as a hub for cryptocurrency exchanges and fintech innovation in Africa. Young Kenyans, particularly those aged 18 to 35, are already actively using virtual assets for trading, payments, investment, and business purposes.

Kuria Kuria added:

“We hope Kenya can become Africa’s gateway for digital assets. By providing a regulated environment, we aim to turn the enthusiasm of our young people into a structured market that drives economic growth.”

With clear rules and oversight, the government aims to attract international crypto companies and fintech startups, encouraging economic development and creating new employment opportunities.

The new law draws inspiration from crypto regulations in the US and UK, combining strong oversight with flexibility for innovation. Earlier in 2025, Kenyan lawmakers approved a multi-agency regulatory approach, involving the CBK, CMA, Communications Authority, Competition Authority, and the Office of the Data Protection Commissioner.

Together, these agencies will handle licensing, market conduct, data protection, and digital infrastructure, establishing a comprehensive and modern system for cryptocurrency regulation in Kenya.

.article-inside-link {

margin-left: 0 !important;

border: 1px solid #0052CC4D;

border-left: 0;

border-right: 0;

padding: 10px 0;

text-align: left;

}

.entry ul.article-inside-link li {

font-size: 14px;

line-height: 21px;

font-weight: 600;

list-style-type: none;

margin-bottom: 0;

display: inline-block;

}

.entry ul.article-inside-link li:last-child {

display: none;

}

- Also Read :

- Kenya Proposes Joint Crypto Regulatory Body as Nation Eyes Leadership in African Crypto Space

- ,

Kenya Joins the African Crypto Leaders

With this legislation, Kenya joins a select group of African nations, including South Africa, that have enacted formal crypto laws. Other countries, such as Uganda, are exploring blockchain projects and central bank digital currencies (CBDCs), reflecting the continent’s growing interest in regulated digital finance.

The VASP Bill signals Kenya’s ambition to lead in creating a safe, legal, and accessible cryptocurrency ecosystem in Africa. Once signed into law, it is expected to:

- Boost investor confidence for local and international participants

- Encourage the establishment of crypto exchanges in Kenya

- Protect users while promoting fintech growth

- Provide clear rules for operating digital assets in a regulated environment

Kenya’s move represents a significant step toward building a sustainable cryptocurrency ecosystem in Africa, paving the way for innovation, investment, and financial inclusion.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The Central Bank of Kenya licenses stablecoins, while the Capital Markets Authority supervises crypto exchanges. This dual approach balances safety and innovation for the market.

Yes. With the new VASP Bill, Kenya has a clear legal framework for crypto. This provides rules for exchanges and protects investors, boosting confidence in the digital asset sector.

You will need to be licensed by the Capital Markets Authority. The new law establishes clear guidelines for operating exchanges, creating a structured and regulated market for businesses.