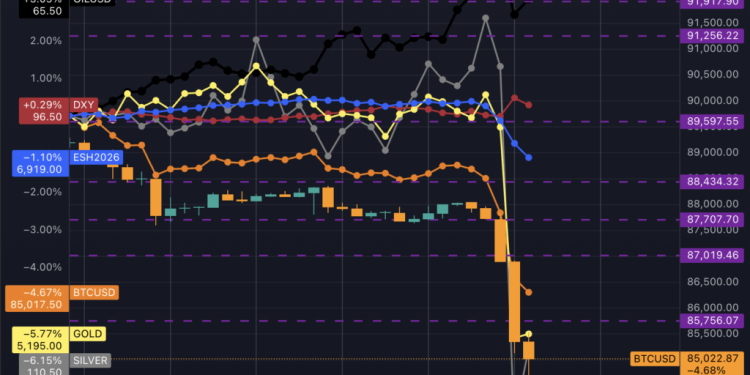

Markets dumped into the US open, Bitcoin fell through $85k, gold slipped too

At 09:30 EST the tape changed in a way traders can feel in their stomach, the kind of flip where you stop looking for clever explanations and start checking how much margin you actually have.

Bitcoin rolled over, then it dropped, then it started moving in chunks. On one screen, the S&P 500 e-mini was sliding, the dollar was firming, oil was ripping higher, and the so called safety metals were getting hit at the same time. A lot of people only needed a few candles to realise this was going to be one of those afternoons where the market sells first and explains itself later.

By 11:00 EST, Bitcoin was trading around $84,434 after hitting an intraday low of $84,365, down roughly 5.4% on the day.

On TradingView, the picture looked brutal in one glance, oil up about 3%, the dollar index up about 0.3%, S&P futures down around 1.1%, Bitcoin off about 4.7%, gold down close to 5.8%, silver down more than 6%. Everything that usually tells a neat story was talking over itself.

And that is the point.

This was a “liquidity wins” move, where positioning matters more than narrative, at least at first. People who came into the day long risk got their answer in the first hour of the US session.

The rumour mill is loud, the market is louder

You will see the speculation, insiders are front running a strike, someone knows something about Iran, the usual.

There is no verified “attack headline” to point to here, at least not from major outlets. What is real is that markets have been trading the risk of escalation in the background, and oil has been reacting hard to it.

The oil move is the cleanest clue, Brent pushed above $71 a barrel, with traders focused on rising US-Iran tension and the chokepoint risk around the Strait of Hormuz.

In other words, you do not need a confirmed event for the market to price the possibility of one. A barrel that jumps is a tax on everything else, it feeds inflation worries, it hits consumer sentiment, it messes with rates, it makes equity investors twitchy, and it can turn a normal selloff into something sharper.

The US open was the trigger point

The timing matters. 09:30 EST is the US cash equity open, the moment where liquidity thickens, and big flows can actually punch through levels.

That is also when a lot of systematic strategies start acting, and when discretionary desks finally have the volume to do what they have been thinking about all morning. If the market has been leaning one way, the open is where the lean gets tested.

In today’s session, US tech weakness was already in the air. Investors were digesting a fresh round of angst around AI infrastructure spending and cloud growth, with Microsoft right at the centre of it.

The Financial Times reported US tech shares sliding after Microsoft’s jump in data centre spending unsettled investors, with the stock falling sharply and dragging sentiment across the complex.

When equities wobble at the open, crypto does not sit politely in a separate universe. Bitcoin trades 24/7, but it is still a global risk asset in the way it gets financed, margined, hedged, and benchmarked. A shaky US open often means crypto gets treated as a levered expression of the same fear.

Why Bitcoin fell so fast

A fast Bitcoin drop usually has a mechanical component, and you could see it in the way price moved.

The first push lower tends to come from spot selling and hedging, then the derivatives market takes over. Stops get hit, funding flips, open interest gets forced down, and liquidations do the rest. The selling becomes less about belief and more about rules, margin requirements, and forced execution.

If you want a single datapoint to watch in real time during these moves, it is liquidation prints and how they cluster around obvious levels.

The most recent data from Coinglass shows over $800 million in liquidations, with $691 million taken from longs over the last 24 hours.

That does not tell you why the first domino fell, it tells you why the second, third, and tenth dominos fell faster than the first.

Gold selling during risk off feels wrong, until you watch it happen

A lot of people will ask the same question, gold is supposed to be the safe place, why did it drop?

The honest answer is that gold behaves differently depending on the phase of the panic.

In the first phase, the market is trying to raise cash. That sounds simple, but it has consequences. Traders sell what they can, not only what they want to. Liquid markets get used as ATMs. Gold is liquid, so it gets hit.

The second part is the dollar. When the dollar firms, it often leans on dollar-priced commodities, at least intraday.

The third part is that gold had already gone parabolic. Gold and silver had been ripping to record highs, then retreated sharply, with speculation and a slightly stronger US dollar in the mix.

Gold hit a record around $5,602 per ounce before dropping back toward $5,100.

When an asset has just run that far that fast, a lot of the “safe haven” demand is already in the price. Once the music stops, the first job is to reduce risk and clean up leverage, and that means selling what has a bid.

If the geopolitical risk persists, gold can still do the thing people expect over a longer window. That is a different time horizon than the first hour of a de risk move.

Using the World Gold Council’s estimate of above-ground supply, the drop from roughly $5,602 an ounce to about $5,100 chopped gold’s implied market value from around $38 trillion to $36 trillion, a loss of roughly $2 trillion, which is on the same scale as the entire crypto market cap at about $3 trillion

The simplest read of the tape

Put the cross-asset picture together, and it reads like this.

Oil surged, which rattled inflation and geopolitics, equities sold off into the US open, the dollar firmed, and leveraged trades got squeezed. Bitcoin, gold, and silver fell together because the market was deleveraging, not because they suddenly share the same fundamentals.

That explanation is less exciting than an “insiders know something” story, but it fits what we can actually point to in public reporting and in price action.

What to watch next

If you are trying to figure out whether this becomes a full-day event or just a nasty flush, a few tells usually matter.

Bitcoin’s response after a liquidation wave is one. If it stabilises and starts reclaiming levels that broke cleanly, the move often gets re framed as a stop run. If it keeps grinding lower with weak bounces, it suggests the selling has moved from forced to deliberate.

Oil is another. The market can absorb a one-off spike, but it struggles with a sustained repricing. If crude keeps marching higher, risk assets usually keep feeling it.

Then there is the dollar. A firm dollar tends to tighten the screws on global liquidity, it also tends to be uncomfortable for risk trades that are financed in dollars.

And of course, watch the headlines, but watch them in the right way. Today has plenty of background noise about Iran, but the market is already trading the fear. If a verified escalation hits the wires, the move can extend. If it does not, the market may start fading the premium, and the bounce can be violent.

For now, the cleanest way to describe the last 90 minutes is simple, the market is reducing risk in real time, and everything that was crowded is getting tested.

Some assets are already trying to recover, whether they will may depend on what happens next in the Middle East.

The post Global markets crash as everything including Bitcoin sells off at once erasing trillions appeared first on CryptoSlate.