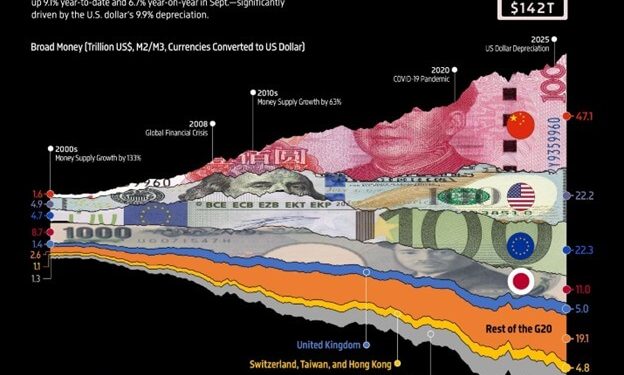

All eyes in global finance are glued to liquidity. As the global broad money supply reaches a record $142 trillion, this monetary firehose has macro investors sitting up in their seats. Surging 6.7% year-on-year as of September, China, the EU, and the U.S. are driving this unprecedented expansion, and Bitcoin and the broader crypto market may be next in line.

The countdown to QE: NY Fed sets the stage

New York Fed President John Williams signaled on Friday that the era of Quantitative Easing (QE) could return sooner than markets were prepared for. With persistent liquidity pressures and money market signals flashing amber, Williams confirmed the central bank is poised to end Quantitative Tightening (QT) and may need to expand its balance sheet again.

Once the balance sheet has reached ample reserves, he told attendees at the European Bank Conference, “it will then be time to begin the process of gradual purchases of assets,” hinting that bond purchases could resume to support market stability.

Many analysts now expect the Fed could restart asset acquisitions as soon as Q1 2026, which would be a watershed event for global liquidity. As macro investor Raoul Pal urged his followers:

“You just need to get through the Window of Pain and The Liquidity Flood lies ahead.”

Massive money supply: Where does the cash go?

The ripples from the money press are global. The Kobeissi Letter broke down the numbers: since 2000, global broad money supply has grown by 446%, up $116 trillion from the turn of the millennium.

China now leads the pack with $47 trillion, followed by the EU and U.S. at $22.3 trillion and $22.2 trillion, respectively. In other words?

“Money supply is through the roof.”

That’s a compounded annual growth rate of 7.0%, and a flood of potential capital hunting yield and shelter from currency debasement.

When liquidity surges like this, it doesn’t slosh evenly; risk assets, hard assets, and new money narratives become magnets for global flows. Bitcoin, notoriously volatile but increasingly institutionalized, looks better positioned than ever to absorb the next reallocation wave, especially as bond yields compress and traditional assets stagnate.

Bad price action… Or bad assumptions?

Crypto Twitter, for all its noise, has spent the week tearing itself apart over red numbers and portfolio trauma. Dan Tapiero, founder of 10T Holdings and a longstanding macro trader, reminded us that bull markets rarely end when panic is everywhere.

“This bull phase in BTC and crypto ends when no one thinks it’s ending (ie not now)… Bad price action is supposed to shake weak hands. Mkts 101.”

He’s not alone in this perspective. Even with frustrating tape and sentiment-charged exits, the structural story of money supply through the roof, and central banks flashing pivot, looks like the perfect setup for another speculative surge.

In fact, the most dangerous time for new capital chasing yield is often when the crowd is convinced the run is already over.

With the NY Fed ready to roll out QE once more and global liquidity showing no sign of slowing, the conditions are ripening for another rally in Bitcoin and crypto.

Weak hands may wobble, but as seasoned macro voices note, real bull phases end in euphoria, not despair. Money pouring into the system must find a home, and the sequence of the global money supply flows may soon ignite the next big leg up in digital assets.

The post Global money supply ‘through the roof’, hitting $142 trillion in September appeared first on CryptoSlate.