Ripple appears to be preparing one of its most ambitious experiments through a $1 billion digital-asset treasury (DAT) designed to accumulate and manage XRP as a long-term reserve.

According to a Bloomberg report, the initiative would be financed through a Special Purpose Acquisition Company (SPAC). This structure is often used in traditional finance to raise capital via IPO and later merge with a target company.

In this case, the shell would become a treasury vehicle that steadily purchases XRP, effectively creating a permanent buyer for the token.

Meanwhile, Ripple would reportedly contribute part of its 4.7 billion liquid XRP holdings (valued near $11 billion), giving the project immediate liquidity and signaling corporate confidence in its ecosystem.

Ripple’s relationship with XRP

Ripple and XRP are related but distinct entities that are often confused with each other.

Ripple is a private crypto company that develops global payment solutions that rely on digital assets like XRP and Ripple USD (RLUSD) for their processes.

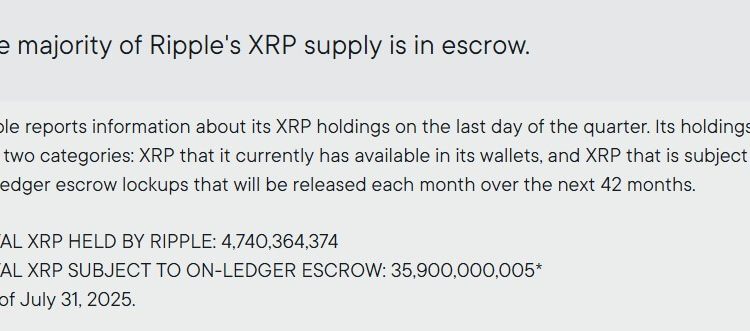

Notably, the firm is also the largest holder of the XRP token, controlling roughly 42% of the 100 billion total supply.

Ripple has 35 billion XRP tokens locked in escrow and releases one billion monthly under an on-ledger schedule. About 60% of those monthly releases are typically re-locked, creating a self-imposed cap that stabilizes issuance and maintains market trust.

Meanwhile, a DAT would flip the script from supply restraint to demand creation.

Instead of moderating outflows, Ripple would indirectly engineer inflows as institutional capital flows into an entity mandated to buy XRP. This would be a structural shift from emission control to market absorption.

XRP treasury companies

The idea of an XRP-focused firm is not entirely new. The crypto industry has seen different iterations of this for several digital assets, including Bitcoin.

Over the past year, a handful of firms have already experimented with XRP-centric reserves to different levels of success.

Notably, Singapore’s Trident Digital announced a $500 million fund in June, while Webus International pursued $300 million in May to back its chauffeur payments network.

Additionally, VivoPower International and Wellgistics followed with smaller allocations of $121 million and $50 million, respectively.

However, their stock performance has been sobering.

Since their announcements, these companies have seen their shares fall by as much as 70%, highlighting how digital-asset treasuries can magnify hype and risk.

Still, some, like Webus and Wellgistics, are doubling down on the XRP ecosystem to grow. For them, XRP treasuries aren’t short-term trades but infrastructure bets, but capital pools to support cross-border liquidity and enterprise payment rails.

Nonetheless, Ripple’s proposed DAT would eclipse them all.

At current prices around $2.30, a $1 billion reserve equals about 435 million XRP, or roughly 0.75% of the 60 billion in circulation, according to CoinGecko data.

How will this affect the XRP price?

An XRP treasury’s steady bid will help to fortify price floors and institutional confidence in the digital asset.

Data from CoinMarketCap shows that XRP’s liquidity on major exchanges is considerably thinner than that of rival tokens like Solana and Ethereum.

Across the ten largest spot venues, including Binance, Coinbase, Bybit, and Upbit, the combined ±2 percent order-book depth amounts to just around $51 million.

At that level, Ripple’s proposed $1 billion digital-asset treasury, if deployed evenly over 90 days at roughly $11 million in daily purchases, would represent more than 20% of all visible near-price liquidity on any given day.

Moreover, it would also equate to roughly twenty times the total depth within that immediate trading band. Such concentration suggests the market could react far more sharply to a sustained buying activity from the DAT firm.

Based on CryptoSlate’s analysis of current exchange depth and historical price elasticity, even moderate execution could meaningfully shift short-term valuations.

| Deployment pace | Share of visible depth absorbed | Modeled short-term impact* | Indicative move (from $2.30) |

|---|---|---|---|

| Slow (180 days) | ≈ 10 % | +2 – 3 % | $2.35 |

| Moderate (90 days) | ≈ 20 % | +6 – 8 % | $2.45 – $2.48 |

| Fast (45 days) | ≈ 40 % + | +12 – 15 % | $2.55 – $2.65 |

While such accumulation would almost certainly involve OTC and algorithmic execution to reduce visible slippage, the concentration of liquidity implies that even careful deployment could trigger a temporary 8–15% price lift before markets adjust.

However, these gains would likely fade if the treasury paused purchases or secondary holders sold into strength.

The post How Ripple’s new $1 billion XRP treasury plans to reshape the token’s future appeared first on CryptoSlate.