BlackRock, the largest asset management firm in the world, has described tokenization as the most critical market upgrade since the early internet.

On the other hand, the International Monetary Fund (IMF) describes it as a volatile, untested architecture that can amplify financial shocks at machine speed.

Both institutions are looking at the same innovation. Yet, the distance between their conclusions captures the most consequential debate in modern finance: whether tokenized markets will reinvent global infrastructure or reproduce its worst fragilities with new velocity.

The institutional divide on tokenization

In a Dec. 1 op-ed for The Economist, BlackRock CEO Larry Fink and COO Rob Goldstein argued that recording asset ownership on digital ledgers represents the next structural step in a decades-long modernization arc.

They framed tokenization as a financial leap comparable to the arrival of SWIFT in 1977 or the shift from paper certificates to electronic trading.

In contrast, the IMF warned in a recent explainer video that tokenized markets could be prone to flash crashes, liquidity fractures, and smart-contract domino cascades that turn local failures into systemic shocks.

The split over tokenization arises from the fact that the two institutions operate under very different mandates.

BlackRock, which has already rolled out tokenized funds and dominates the spot ETF market for digital assets, approaches tokenization as an infrastructure play. Its incentive is to expand global market access, compress settlement cycles to “T+0,” and broaden the investable universe.

In that context, blockchain-based ledgers look like the next logical step in the evolution of financial plumbing. This means the technology offers a way to strip out costs and latency in the traditional financial world.

However, the IMF operates from the opposite direction.

As the stabilizer of the global monetary system, it focuses on the hard-to-predict feedback loops that arise when markets operate at extremely high speed. Traditional finance relies on settlement delays to net transactions and conserve liquidity.

Tokenization introduces instantaneous settlement and composability across smart contracts. That structure is efficient in calm periods but can propagate shocks far faster than human intermediaries can respond.

These perspectives do not contradict each other so much as they reflect different layers of responsibility.

BlackRock is tasked with building the next generation of investment products. The IMF is tasked with identifying the fault lines before they spread. Tokenization sits at the intersection of that tension.

A technology with two futures

Fink and Goldstein describe tokenization as a bridge “built from both sides of a river,” connecting traditional institutions with digital-first innovators.

They argue that shared digital ledgers can eliminate slow, manual processes and replace disparate settlement pipelines with standardized rails that participants across jurisdictions can verify instantly.

This view is not theoretical, though the data requires careful parsing.

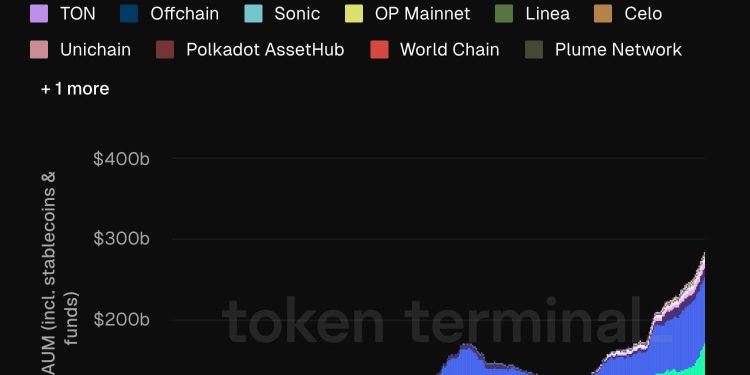

According to Token Terminal, the broader tokenized ecosystem is approaching $300 billion, a figure heavily anchored by dollar-pegged stablecoins like USDT and USDC.

However, the actual test lies in the roughly $30 billion wedge of regulated real-world assets (RWAs), such as tokenized Treasuries, private credit, and bonds.

Indeed, these regulated assets are no longer restricted to pilot programs.

Tokenized government bond funds such as BlackRock’s BUIDL and Ondo’s products are now live. At the same time, precious metals have moved on-chain as well, with significant volumes in digital gold.

The market has also seen fractionalized real estate shares and tokenized private credit instruments expand the investable universe beyond listed bonds and equities.

In light of this, forecasts for this sector range from the optimistic to the astronomical. Reports from firms such as RedStone Finance project a “blue sky” scenario in which on-chain RWAs could reach $30 trillion by 2034.

Meanwhile, more conservative estimates from McKinsey & Co. suggest the market could double as funds and treasuries migrate to blockchain rails.

For BlackRock, even the conservative case represents a multi-trillion-dollar restructuring of financial infrastructure.

Yet the IMF sees a parallel, less stable future. Its concern centers on the mechanics of atomic settlement.

In today’s markets, trades are often “netted” at the end of the day, meaning banks only need to move the difference between what they bought and sold. Atomic settlement requires every trade to be fully funded instantly.

In stressed conditions, this demand for pre-funded liquidity can spike, potentially causing liquidity to evaporate exactly when it is needed most.

If automated contracts then trigger liquidations “like falling dominoes,” a localized problem could become a systemic cascade before regulators even receive the alert.

The liquidity paradox

Part of the enthusiasm around tokenization stems from the question of where the next cycle of market growth may originate.

The last crypto cycle was characterized by memecoin-driven speculation, which generated high activity but drained liquidity without expanding long-term adoption.

Advocates of tokenization argue that the next expansion will be driven not by retail speculation but by institutional yield strategies, including tokenized private credit, real-world debt instruments, and enterprise-grade vaults delivering predictable returns.

Tokenization, in this framing, is not merely a technical upgrade but a new liquidity channel. Institutional allocators facing a constrained traditional yield environment may migrate to tokenized credit markets, where automated strategies and programmable settlement can yield higher, more efficient returns.

However, this future remains unrealized because large banks, insurers, and pension funds face regulatory constraints.

The Basel III Endgame rules, for example, assign punitive capital treatment to certain digital assets classified as “Group 2,” discouraging exposure to tokenized instruments unless regulators clarify the distinctions between volatile cryptocurrencies and regulated tokenized securities.

Until that boundary is defined, the “wall of money” remains more potential than reality.

Furthermore, the IMF argues that even if the funds arrive, they carry hidden leverage.

A complex stack of automated contracts, collateralized debt positions, and tokenized credit instruments may create recursive dependencies.

During periods of volatility, these chains can unwind faster than risk engines are designed to handle. The very features that make tokenization attractive, such as the instant settlement, composability, and global access, create feedback mechanisms that could amplify stress.

The tokenization question

The debate between BlackRock and the IMF is not about whether tokenization will integrate into global markets; it already has.

It is about the trajectory of that integration. One path envisions a more efficient, accessible, globally synchronized market structure. The other anticipates a landscape where speed and connectivity create new forms of systemic vulnerability.

However, in that future, the outcome will depend on whether global institutions can converge on coherent standards for interoperability, disclosure, and automated risk controls.

The post IMF stark warning of uncontrollable crypto domino effect as BlackRock bets on tokenization appeared first on CryptoSlate.