Welcome to Slate Sundays, CryptoSlate’s new weekly feature showcasing in-depth interviews, expert analysis, and thought-provoking op-eds that go beyond the headlines to explore the ideas and voices shaping the future of crypto.

Lyn Alden is an exceptional human.

Broadly recognized as one of the top minds in macroeconomics, during a conversation with Lyn, you can feel some of her vast intellect rubbing off on you; I swear my IQ increased several points by the time our chat was over.

Even navigating heavy topics like the fiscal deficit and the onset of AI, she does so with a smile on her face and more eloquence and poise than an Olympic gymnast executing a triple backflip.

Founder of Lyn Alden Investment Strategy and general partner at venture firm Ego Death Capital, alongside other industry heavyweights like Jeff Booth and Preston Pysh, Lyn has earned her stripes over the years as one of the most respected macro analysts in the space.

She’s also one of the most solicited for interviews, thanks to her razor-sharp insights and depth of market knowledge.

As a prolific content creator, Lyn offers a free investing newsletter and frequents the virtual corridors of Crypto Twitter daily, amassing three-quarters of a million followers who rely on her timely commentary and finely-edged wit: beyond the undeniable words of wisdom and investment advice, Lyn’s something of a master when it comes to memes.

Nothing stops this train

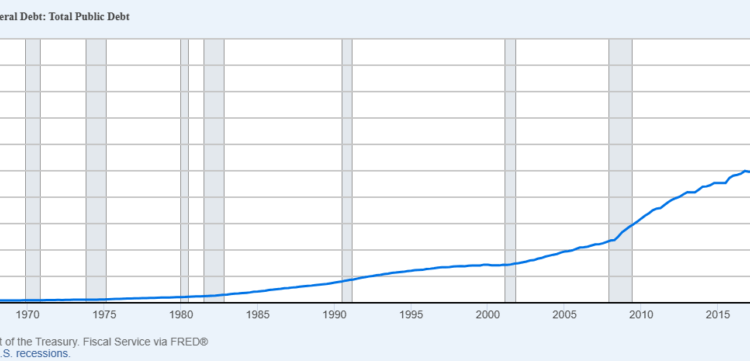

Lyn is perhaps best known for her book Broken Money, which provides a comprehensive view of the history of money and a well-illustrated critique of the global monetary system. She’s also highly vocal about her thesis on the U.S. fiscal deficit, AKA, ‘Nothing stops this train’.

Sky-high levels of U.S. spending are rising at a pace that far outstrips the government’s ability to pay for it, creating what Lyn dubs a “slow-motion runaway train.” She explains:

“Large U.S. fiscal deficits are going to continue for the foreseeable future, five, 10 years, any sort of investable time horizon. There are a bunch of reasons why, and a lot of them have to do with political polarization. It’s very hard to either massively raise taxes or massively cut spending in a very polarized situation, as well as mechanically the kind of debt levels they find themselves in.”

The total amount of money the U.S. government owes to its lenders currently amounts to an eye-watering $36.9 trillion, representing over 120% of GDP, and growing by around $1 trillion every quarter.

Even the most highly skilled ringmaster with smoke and mirrors would struggle to obfuscate such an alarming level of federal debt. With a diminishing ability to pay it off, I wonder, if nothing stops this train, can anything slow it down? She replies:

“There are plenty of things that can slow it down a little bit. Tariffs are one of the things that can slow it down because they bypass some of that polarization. Tariffs are basically really big tax hikes that go around Congress because of an emergency authorization executive order, so they temporarily bypass some of the frictions against them.”

While tariffs may serve to fill the government coffers a little higher, Lyn says the numbers don’t add up enough to make a significant impact: the deficit is around $2 trillion, and the income from tariffs at the current level only equates to roughly a quarter of it at around $500 billion a year. Plus, “we’re already seeing exemptions.” She adds:

“The last line for the ‘Nothing stops this train’ view is that the U.S. is very financialized, meaning that our government’s tax receipts are very correlated with asset prices. Any attempts at austerity at this point tend to fail to address the problem because you either slow down the stock market or slow down the economy. Therefore, with a lag, you weaken your other tax receipts and make deficit reduction on a sustained basis hard.”

I nod, contemplating the enormity of the situation and the inevitable collision course the economy is on. She continues:

“Just structurally, it’s growing above target almost without any way to stop it.”

The outlook for Bitcoin and broader crypto markets

We turn the conversation to last week’s market slump following a weaker-than-expected jobs report that triggered former BitMEX CEO Arthur Hayes to sell off a chunk of his crypto holdings. I ask Lyn how significant the jobs report is and whether she echoes Hayes’ bearish near-term views on global liquidity.

She frowns, pointing out that Hayes is more of a frequent trader than she is, however:

“The jobs report was pretty significant. It was the biggest downward revision in quite a while, and it’s corroborated by other things as well. The ISM Purchasing Managers’ indices are also showing a similar directional weakness.”

The ISM Manufacturing PMI is a key indicator of the state of the U.S. economy as it signals the level of demand for products by measuring the amount of ordering activity at U.S. factories. Lyn continues:

“Now, whether that affects Bitcoin and broader crypto, I’m more hesitant to say. While it can slow down earnings that can impair the economy in various ways, it also generally means more Fed dovishness, which, around the margins, is good for Bitcoin and crypto.”

Despite not making short-term trading decisions like Hayes, Lyn gives some credence to his outlook over the coming quarters based on a couple of parameters:

Tariffs may make a dent in the deficit and serve to take the wind out of crypto’s sails (“slightly slower the train for a couple of quarters”), and the treasury is attempting to refill its general cash account (the TGA) after the debt ceiling was passed. That means sucking liquidity out of the system, which can negatively impact risk assets. Lyn explains:

“Ironically, debt ceilings, when they’re an issue, are actually good for liquidity because they force all these pockets of liquidity to go back into the market, but then afterward, when they refill their cash levels, they’re pulling cash out of the system.

They [the treasury] expect to do that through the rest of this quarter, to Arthur’s point, which is historically not amazing for asset prices across the board.”

In contrast, Lyn isn’t too worried about a broader tightening of global liquidity. She says:

“I would say liquidity’s in a middling place because the dollar is no longer falling as it was earlier this year, and the dollar is a really big variable for liquidity, generally. A falling dollar is overall good for global liquidity. At the other end of the spectrum, China’s credit impulse is on the upswing, which is good for global liquidity. So it’s kind of neutral at the current time.”

Bitcoin cycles will be longer and less extreme

While it’s not the perfect setup for a million-dollar Bitcoin, things could definitely be worse. Lyn affirms:

“I don’t think this cycle’s over yet. I think we’re going to see higher highs in Bitcoin this cycle. That could be later this year. That could be early next year. There are lots of little variables that can affect that, but so far, we don’t see any indicators that look like a multi-year top.”

In fact, she explains that we’re “nowhere near multi-year tops” based on various indicators that track market value compared to on-chain cost basis, a “kind of a measure of euphoria.”

“I think liquidity still looks decent, maybe not great for a quarter, but it’s not an acute headwind per se, in my opinion, and going into next year, I still think we’re going to see most likely higher Bitcoin prices.”

How high is that?

Lyn pauses and says she has no firm view. Unlike other personalities in the space, she doesn’t win over more followers by making outlandish predictions. Instead, she simply says:

“I think we’re going over $150k this cycle. Now the number could be much higher than that, but I always try to start conservatively, and it depends on market conditions at that time.”

She believes that Bitcoin cycles are changing, and we should expect this one to be longer and “maybe less extreme” than previous runs. We should also prepare to see strong moves upward followed by periods of consolidation, “rather than going to the moon and collapsing.”

“If you look at what used to be called FANG stocks, and now it’s the Mag7 stocks, basically large-cap U.S. tech stocks, they kept grinding up longer than people thought. Value investors were always shocked that these things just kept growing.

“Sometimes they get over their skis and have a 30% correction, sometimes worse. Sometimes they have a flattish, choppy year, but then they keep grinding higher after they work out some steam. I think Bitcoin could resemble that model to some extent. Maybe it’s still more volatile than that, but I do think we should expect maybe longer and less extreme cycles on average.”

Bitcoin treasury companies: bear market catalyst?

For anyone who’s been flushed out by a Mt. Gox, China ban, or FTX-style black swan event that abruptly reversed most of Bitcoin’s gains, Lyn’s prediction may provide some relief. But is there any potential catalyst for the end of the cycle quietly chirping away like a canary in a coal mine? Bitcoin treasury companies, for example?

Lyn points out that now that Bitcoin is a multitrillion-dollar asset, it’s inevitable that smart money flows in. She says:

“There’s no world in which only individuals own Bitcoin and magically no large pools of capital want to own it. That only makes sense when Bitcoin is a tiny market.”

She’s not concerned about the centralization threat to Bitcoin posed by entities like Strategy gobbling up BTC like it’s going out of style (Strategy’s BTC holdings currently stand at over 628,791, just shy of 3% of the entire supply). She simply shrugs and says it’s no different from previous cycles:

“At one point, Mt. Gox supposedly had over 800,000 coins, and there were fewer coins back then. So that was a bigger percentage of coins than, say, BlackRock or Strategy has now. So while there’s always some degree of centralization concerns, it’s really not worse now than it was at periods of times in the past. So, no. I’m not really worried about that from a centralization perspective.”

What is important to be on the lookout for, Lyn explains, is the amount of leverage in the system, since “any degree of euphoria and leverage is what causes the next downward cycle.” Bitcoin needs upward volatility to go from zero to trillions of dollars of value and become relevant on a global scale; and upward volatility, Lyn warns, breeds euphoria and leverage.

“That’s when you get over your skis and you get consolidations and downside volatility. There are obviously other liquidations that happen from time to time, so they certainly could feed the next downturn, but I don’t view it as fundamentally different from prior cycles, and the current leverage in the treasury space is not that high.

MicroStrategy has pretty low leverage relative to their Bitcoin. Metaplanet has relatively low leverage relative to their Bitcoin. We’ll see how the others come as they go. I certainly think that we’ll see a washout. We’ll see a lot of altcoin treasury companies get washed out, and some Bitcoin ones that are poorly managed are going to be at risk in the next downturn.”

The roaring 20s and the decade-long inflation

It was sometime during the COVID lockdowns that Lyn began discussing the persistent inflation that would stem from shuttering the world and inflating the money supply. She would later characterize the 2020s as the decade of inflation, as governments struggle to rein in rising costs. Does Lyn expect this trend to continue?

“To some extent, I mean, we’re in 2025. We’re still above the way the Fed measures inflation. We’re still above their official target even though it has come down. Now, whether or not we have another dramatic spike comes partially down to whether energy is constrained or not. It’s pretty hard to have major inflation without energy suppression, so anything that keeps the supply of energy high is a way of keeping inflation down.”

Unlike previous decades, she says, where we were able to print money and offset it with productivity gains from automating manufacturing, she sees the 2020s as “stickier” in terms of average inflation; unless we realize a major productivity increase through a technology such as AI, although even that won’t bring down the cost of store-of-value assets. She says:

“The things that are truly scarce, like waterfront property, gold, fine art, high-quality stocks, and things like that, all go up dramatically because it’s hard to increase those things. So I think going forward, AI making, say, white collar types of services cheaper can suppress in some way CPI and certain wages and expenditures that people have.

This could be offset by ongoing money printing, higher gold, higher Bitcoin, higher prestige properties, and just truly scarce things. So I do think that we’re still in a sticky inflation environment, even though it’s hard to get dramatic inflation without energy shortages.”

AI and the economics of white-collar work

Since she’s brought up AI for its productivity gains, I ask if she’s concerned about job losses and whether she believes it’s a net positive for humanity, being something of an AI skeptic myself. Lyn’s markedly more optimistic. Just like the runaway fiscal deficit train, she says AI is inevitable.

“At this stage, if you try to ban it in one country, another will do it, and it will be open-sourced in some capacity. Like any technology, it can be disruptive when it hits; a lot of people can lose their jobs at once.”

She likens AI to social media in the way the latter disrupted social interaction, and warns that it must be used carefully to avoid doing more harm than good. I recall reading an MIT study, to her point, that found AI to be a great learning tool; as long as people didn’t become so dependent on it that their intelligence drained away like blood from an open wound.

Lyn continues:

“It’s a good thing that we find ways to make repetitive white-collar work cheaper and more affordable because that allows those people or future generations to do other types of work, which is true for any time we automated textiles or farming with tractors and hydrocarbons and things like that. It’s the same thing except it’s quicker.”

She points out that portable AI is different from data center AI and marvels at the mechanics of the human brain: our ability to process complex thoughts and emotions, “very high bandwidth senses,” and “self-healing” capability run on just 20 watts of power. She enthuses:

“It’s remarkable. It’s less than an incandescent light bulb. The equivalent amount of processing in a data center runs on megawatts of power, so millions of watts of power…

I don’t think we’re anywhere near the level where there’s nothing humans could do to add value over silicon. I think it’s more a case of disruption that then puts more people into doing other things.”

I nod, wondering whether my metaphorical lightbulb requires as much energy as Lyn Alden’s giant brain.

Inflation, disruption, broken money… oh my!

With persistent inflation, societal disruption, and broken money, to boot, this era bears all the hallmarks of a fourth turning, and I struggle to feel positive about where it all ends. I wonder what Lyn thinks. Is this a good time to be alive? She ponders:

“I think so. Fewer people die from avoidable things than almost ever before globally. It’s not an accident that the population bubble is happening now… For the most part, I consider it good, but it goes through waves of getting too much, like when people get cut off from social connections. People have way more depression now than hunter-gatherers, even though in most capacities, we live longer and are less likely to die from something random…

Technology is polarizing because, in some ways, it becomes like a winner-take-most, and to the extent that we get through this whole thing successfully, I think we have to learn to use technology in a more natural way than be so reliant on it. I think eventually that will be the case.”

Lyn also believes that AI won’t continue to develop and improve ad infinitum, but will eventually hit a plateau, just like aviation did: progress within that industry has been fairly stagnant for years, following its mind-blowing takeoff in the 20th Century. She says:

“We went from the Wright brothers to people on the moon in one human lifetime. But then, once we hit the 70s, we slowed down. We still don’t have a jet faster than the Blackbird. We still don’t have commercial aviation faster than the Concorde. We don’t even have that anymore…

I think in time, similar things will happen to electronics where we’ll reach certain densities that are hard to keep dramatically improving on, and it will allow us more time to absorb what we already have.”

Follow Lyn Alden on X or check out lynalden.com for in-depth analysis and insights.

The post Inside the mind of Lyn Alden: Bitcoin, AI, and the unstoppable deficit train appeared first on CryptoSlate.