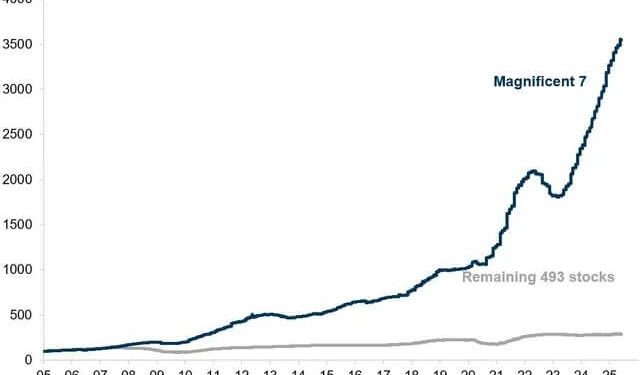

A cursory glance at the Magnificent 7 stocks chart reveals a clear trajectory: up only. But when layered against all other stocks, an even more interesting pattern emerges. 493 stocks remain relatively flat while the Mag 7s take a steep upward grind, like climbing the Eiger. As Bitcoin advocate and founder of The Network State, Balaji Srinivasan, muses:

“My explanation is that the legacy economy is being sunset in favor of the Internet economy.”

Stripe CEO Patrick Collison ruminated on similar data, highlighting a trend emerging across Google, Apple, and Microsoft. He questioned why the companies exhibited the same growth dynamics when they are “ostensibly in totally different businesses,’ to which Balaji replied:

“I think those graphs reflect the secular shift towards the Internet. Almost every action that was once done offline is moving online, and routed through tech companies.”

Mapping the digital migration

What’s going on here? Patterns that would once have been dismissed as coincidences now seem to signal something deeper.

The “secular shift” is economist-speak for a permanent, structural change. In this case, it’s the decades-long migration from offline to online across the global economy.

From grocery orders to financial transactions, human interactions, and even remote work, the COVID-accelerated rush to digital has become the main route for commerce and connection.

The Balaji thesis: the internet swallows the world

Balaji’s response to Collison’s question made explicit what many now intuitively sense: tech companies aren’t just growing, they’re becoming the primary infrastructure for life itself.

“Legacy” sectors like real estate, banking, and manufacturing are being reoriented, rewired, or outright replaced by software. In Balaji’s words, almost every offline activity is “routed through tech companies,” as digital-first solutions offer scale, efficiency, and global reach previously unimaginable.

This is not an innovation cycle but a replatforming. It’s why companies that once had nothing in common now show the same growth curves or contraction risks: the offline world is contracting, while the internet economy swells to fill the gap.

For investors and founders, these trends reinforce a simple imperative: bet on digital, or risk obsolescence. The parallel growth patterns across disconnected verticals suggest that internet penetration is now the single biggest driver of economic fate.

Tech companies, with their network effects and digital rails, become the middlemen for everything. They reinforce the winner-take-most dynamic so apparent in today’s markets.

For policymakers, there’s a warning: the digital divide will only widen unless deliberate intervention closes it. As more actions from life are intermediated by platforms, the cost of being unconnected grows.

The trajectory of Magnificent 7 stocks, and, in particular, Google, Microsoft, and Apple, shines a light on a future where the majority of human action runs through software. It’s a world reshaped not by a single breakthrough, but by the universal, irreversible shift from meatspace to cyberspace.

The evidence is in the charts, and the trend is only getting steeper.

The post Mag 7s’ trajectory shows legacy economy ‘being sunset’ for the digital age appeared first on CryptoSlate.