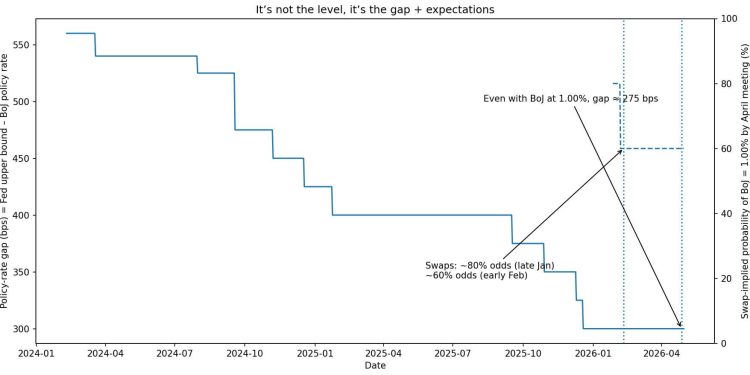

Bank of America Securities expects the Bank of Japan (BoJ) to raise its policy rate from 0.75% to 1.0% at its April 27-28 meeting. Markets already price roughly 80% odds of that outcome, according to swap data cited in recent BoJ meeting minutes.

The 25-basis-point move itself sounds modest, but the debate it has sparked runs deeper: could a return to 1% policy rates, last seen in Japan’s mid-1990s, trigger a global carry-trade unwind that forces deleveraging across risk assets, including Bitcoin?

In August 2024, a sharp yen rally tied to the unwinding of carry trade sent Bitcoin and Ethereum down as much as 20% in a matter of hours.

The Bank for International Settlements later documented the episode as a case study in forced deleveraging: margin calls cascaded across futures, options, and collateral structures, and crypto took the hit.

So when headlines now invoke the specter of “Japan at 1%” and “systemic risk,” the issue is whether history rhymes or whether this time the script is different.

The 1995 parallel and where it breaks down

On April 14, 1995, the Bank of Japan set its basic discount rate at 1.00%. By April 19, the dollar had collapsed to 79.75 yen, a post-Plaza Accord low that forced coordinated intervention.

Five months later, BoJ cut the discount rate to 0.50%, the start of a multi-decade experiment in ultra-low rates.

That year also followed the 1994 “Great Bond Massacre,” a global selloff that wiped an estimated $1.5 trillion from bond portfolios as US and European rates surged.

The confluence of those shocks, consisting of yen strength, bond volatility, and rate uncertainty, created the kind of macro turbulence that now gets invoked whenever Japan’s policy stance shifts.

However, the mechanics today are different. In 1995, the yen’s strength resulted from Japan’s current account surplus ballooning and foreign capital fleeing dollar-denominated assets. The policy rate move was a response, not the primary cause.

Today, the Federal Reserve holds rates at 3.50-3.75%, still 275 basis points above Japan’s current 0.75%, and that differential sustains the structural logic of the yen carry trade: borrow in yen at near-zero cost, invest in higher-yielding US or emerging market assets, pocket the spread.

A single 25 bps hike to 1.0% doesn’t erase that gap. What it can do is change expectations about the trajectory. And expectations, not the absolute level, drive currency volatility.

How carry trades unwind and why volatility matters

A carry trade’s payoff is straightforward: investors earn the interest differential, minus any currency appreciation on the funding leg.

Borrowing yen at 0.75% and earning 3.5% in dollars results in a net of roughly 2.75%, until the yen strengthens 2.75% and wipes out the gains. Leverage amplifies this dynamic.

At 10x leverage, a 1% yen move translates into a 10% equity drawdown, enough to trigger margin calls and forced selling.

The risk isn’t the hike itself. The risk is a hike that surprises, combined with positioning extremes and thin liquidity. In August 2024, the BoJ raised rates and signaled a more hawkish stance than markets had expected.

The yen rallied sharply. Volatility-targeting funds, which mechanically cut exposure when volatility rises, sold equities and other risk assets.

Futures positions unwound. Cross-currency basis spreads, which are the cost of hedging dollar liabilities with yen funding, blew out. Bitcoin, treated as liquid collateral by macro funds and frequently held in levered structures, sold off alongside tech stocks and high-beta equities.

The BIS documented the sequence: leveraged positions in crypto derivatives compounded the selloff, with liquidations accelerating as stop-losses and margin thresholds were breached.

The episode proved that Bitcoin, despite its narrative as a non-correlated asset, behaves like a risk-on trade when global liquidity conditions tighten suddenly.

Japan’s Treasury holdings and the ‘repatriation’ channel

Japan holds approximately $1.2 trillion in US Treasuries as of November, making it the largest foreign creditor to the US.

When the BoJ raises rates, the yield gap between Japanese Government Bonds and Treasuries narrows.

Japanese institutional investors, such as pension funds, life insurers, and banks, face a different calculation: why hold 10-year Treasuries at 4.0% and bear currency risk when JGBs now yield closer to 1.5% and carry no FX exposure?

This rebalancing doesn’t happen overnight, but it happens.

Treasury International Capital (TIC) data track these flows, and any sustained decline in Japanese holdings would put upward pressure on US yields, thereby tightening global financial conditions.

Higher Treasury yields mean higher discount rates for all risk assets, including Bitcoin.

The effect is indirect but real: Bitcoin’s valuation is partly a function of the opportunity cost of holding it versus risk-free assets, and when that opportunity cost rises, speculative demand weakens.

The flip side matters too. If the BoJ disappoints hawks and holds rates steady, July or September becomes the next live window, after which the carry trade rebuilds, the yen weakens, and the repatriation narrative fades.

Risk appetite improves, and Bitcoin is likely to trade higher alongside equities and credit.

Scenarios for April and what they mean for Bitcoin

There are three potential scenarios for April.

The first scenario involves the BoJ raising rates to 1.0% in April, but guidance remains measured: “data-dependent,” “gradual normalization,” and no signal of accelerated tightening.

The yen strengthens modestly, and volatility stays contained.

Bitcoin’s reaction is muted or short-lived. Any dip reflects broader risk-off sentiment rather than forced deleveraging. US dollar liquidity and equity market tone matter more than the hike itself.

The second scenario becomes concrete if the hike is accompanied by hawkish forward guidance or coincides with stronger-than-expected Japanese wage data.

The yen rallies sharply, up to 5% in a week, driven by stop-loss orders and speculative position covering. Cross-currency basis spreads widen. Volatility-control strategies cut exposure. Margin calls hit macro funds and crypto derivatives traders. Bitcoin sells off 10% to 20%, mirroring the August 2024 episode.

This is the systemic risk scenario: not because the rate level is catastrophic, but because the speed and positioning create a liquidity event.

The third and less likely scenario is where BoJ waits, citing weaker first-quarter data or political uncertainty. Markets reprice, the yen weakens. Carry trades rebuild. Bitcoin catches a bid alongside other risk assets as the narrative shift lifts sentiment.

The April meeting becomes a non-event, and focus turns to later-year meetings.

| Scenario | Market pricing vs outcome | Surprise score (bps) (actual – implied) | JPY move (range) | USD/JPY implied vol | Cross-currency basis | Risk assets | BTC expected response | What to watch |

|---|---|---|---|---|---|---|---|---|

| Measured hike (BoJ 0.75% → 1.00%) + gradual guidance | Mostly priced (e.g., “~80% odds”) | ≈ +5 bps (0.75→1.00 vs ~0.95 implied) | JPY +1% to +2% | Contained (small uptick) | Stable (minor widening at most) | Mild de-risk; orderly rotation | Muted / short-lived dip; follows broader risk tone | BoJ wording (“gradual”, “data-dependent”), USDJPY vol staying low, positioning not extreme |

| Hawkish surprise (1.00% + faster-path signal) | Partially unpriced (path surprise) | ≈ +25 to +50 bps (path repricing dominates) | JPY +3% to +5% (stop-outs/squeeze) | Spikes (vol accelerant) | Widens (hedging/funding stress) | Vol-control selling; deleveraging across risk | −10% to −20% (liquidity/forced selling risk) | BoJ path language (terminal rate hints), wage/inflation prints, CFTC yen shorts, cross-asset vol, basis/bank funding headlines |

| No hike (hold 0.75% + dovish tilt) | Unpriced / repricing lower | ≈ −20 bps (0.75 vs ~0.95 implied) | JPY −1% to −2% | Fades | Narrows | Relief rally; carry rebuilds | Risk-on bid; trades up with equities/credit | BoJ emphasis on downside risks, next “live” window (July/Sep), USD liquidity tone, TIC flow trend (repatriation narrative cooling) |

What to watch instead of doomscrolling

The answer to “Is BoJ to 1% a systemic risk?” depends entirely on execution and context.

A telegraphed, orderly move is a non-event. A surprise, coupled with thin markets and crowded positioning, can trigger volatility that cascades.

To better understand the potential implications, investors should closely monitor the April 27-28 BoJ statement and Outlook Report. Not just the decision, but the language around future hikes and inflation expectations.

Additionally, it is important to monitor USDJPY implied volatility, not just the spot rate, as volatility is the accelerant.

Watching CFTC positioning data for extremes in yen shorts, which can fuel squeezes, is also advised. Lastly, following TIC data for signs of Japanese Treasury repatriation, even if the flow is gradual.

Bitcoin’s role in this dynamic is clear: it’s liquid, it’s levered, and it’s treated as risk collateral by the same macro traders who run yen carry strategies.

When those trades unwind violently, Bitcoin sells off. However, when they unwind gradually (or don’t unwind at all), Bitcoin’s correlation to traditional risk assets weakens, and it trades more on its own supply dynamics and institutional adoption trajectory.

The BoJ hike to 1% is real. The risk of a carry unwind is real. But the risk is conditional, not inevitable.

Markets have priced in a high probability of the move, thereby diffusing some of the surprise premium.

The question now is whether the path beyond 1% looks gradual or accelerated, and whether global liquidity conditions can absorb the adjustment without breaking.

For Bitcoin, that’s the difference between a volatility event to monitor and a systemic shock to prepare for.

The post Odds Bank of Japan raises rates hits 80% with Bitcoin on the sideline – one hidden signal decides everything appeared first on CryptoSlate.