Stablecoins were once a minor appendage of crypto markets, a functional parking spot for traders cycling between Bitcoin and Ethereum. However, framing no longer fits.

With a circulating supply above $300 billion and annual trading volumes exceeding $23 trillion in 2024, stablecoins have matured into a parallel dollar infrastructure. They extend US monetary power into markets where financial systems are fragile or inefficient, while exposing fault lines for countries that rely on them most.

Meanwhile, the headline numbers require some nuance. A large share of that $23 trillion volume still reflects high-frequency trading loops on centralized exchanges.

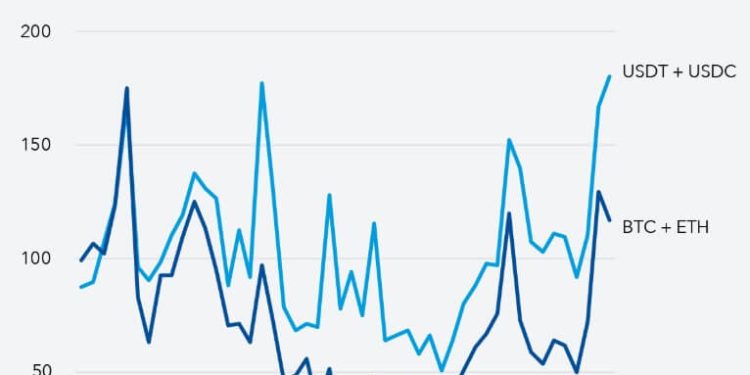

However, the composition of flows is shifting. Cross-border stablecoin transfers, which are a closer proxy for real-economy usage, reached record highs in 2025, surpassing Bitcoin and Ethereum for the first time.

According to the International Monetary Fund (IMF), Asia accounts for the largest share of volume, while Africa, Latin America, and the Middle East show the fastest growth relative to GDP.

As a result, the IMF, which once viewed these tokens as niche tools for crypto settlement, now describes them as “the digital edge of the dollar system.” The phrase captures both their utility and the extent to which they bypass the traditional channels of monetary control.

A liquidity escape valve

For households and small businesses in Nigeria, Argentina, or Turkey, stablecoins are rarely speculative assets. They are instruments of economic survival.

In Nigeria, where multiple exchange rates and FX shortages distort access to the dollar, USDT volumes on informal peer-to-peer markets often exceed official channels. In inflation-ravaged Argentina, local fintech studies show stablecoins are now a preferred savings tool, especially among younger workers.

The appeal is straightforward: stablecoins preserve purchasing power, settle instantly, and require no interaction with domestic banks.

Unlike legacy dollarization, which relies on physical cash or slow correspondent banking corridors, digital dollarization moves at the speed of the internet. A saver can exit the local currency in seconds, bypassing FX controls, deposit insurance structures, and bank balance sheets.

This shift is visible in emerging-market liquidity data.

Banking giant Standard Chartered estimates that banks in the emerging markets could lose as much as $1 trillion in deposits as savers migrate from low-yielding domestic accounts to dollar-denominated stablecoins backed by US Treasuries.

For regulators, this resembles a slow but persistent run, leading to liquidity reallocation into offshore dollar instruments that fall outside their supervisory perimeter.

The dominant issuer in these regions is not a regulated US entity but Tether, whose offshore structure places it outside immediate US prudential oversight. Tether is the dominant stablecoin issuer, with its USDT stablecoin having a circulating supply of nearly $190 billion.

However, its liquidity, familiarity, and availability give it a structural advantage in markets with low banking penetration and high capital controls.

A new buyer in the Treasury market

Stablecoins are also reshaping demand for short-term US government debt. Because most major issuers, like Tether, back their tokens with Treasury bills and repos, their expansion makes them meaningful marginal buyers in the money markets.

The IMF notes that under certain conditions, a $3.5 billion increase in stablecoin issuance could compress short-term Treasury yields by roughly two basis points. That may seem small, but in one of the world’s deepest markets, such sensitivity signals that stablecoins are becoming a non-trivial participant.

Forecasts vary, but several analysts project the stablecoin sector could grow to between $2 trillion and $3.7 trillion by 2030, depending on regulatory clarity and institutional adoption. At the upper end, stablecoins would hold T-bills enough to influence liquidity conditions at the short end of the curve.

Yet stablecoin issuers operate without the liquidity backstops available to money-market funds. Their business model is a rigid pass-through: yield on reserves accrues to the issuer, while liquidity and counterparty risk fall to users.

In a redemption shock triggered by regulatory action, market stress, or a loss of confidence, issuers could be forced to liquidate T-bills amid deteriorating conditions.

A fragmented regulatory map

Until recently, the regulatory landscape for stablecoins was defined by fragmentation.

The EU’s Markets in Crypto-Assets Regulation (MiCA) regime requires substantial portions of reserves to be held in liquid deposits and bans the payment of interest to users. On the other hand, Japan has opted for a “bancarized” model, limiting issuance to banks and trust companies.

The UK is designing a dual system in which the Bank of England supervises systemic issuers that are mainly backed by central bank deposits, effectively turning them into synthetic CBDCs.

Meanwhile, the United States has taken a central role by introducing a framework, the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, that alters the global map.

The GENIUS Act is the first cohesive federal proposal for dollar-backed stablecoins.

The regulation permits both banks and licensed non-bank institutions to issue fully collateralized tokens backed by cash, T-bills, and repos. It establishes clear redemption rights, mandates segregation of reserves, and places issuers under a federal licensing structure independent of securities regulation.

As a result, the GENIUS Act has made the US the world’s most scalable and issuer-friendly stablecoin regime:

- less restrictive than Europe,

- more flexible than Japan,

- and more market-oriented than the UK’s synthetic-CBDC approach.

Essentially, the framework has consolidated the US as the primary jurisdiction for onshore issuance.

However, it could also intensify pressures on emerging markets. By legitimizing and institutionalizing digital dollars, GENIUS has accelerated adoption abroad, increased deposit flight from EM banks, and deepened demand for US debt, while leaving non-US regulators with limited tools to slow the shift.

For context, data from Artemis shows that stablecoin US for payments has grown by more than 70% since the US’s regulatory efforts.

Meanwhile, other financial hubs, including Singapore, Hong Kong, and the UAE, are crafting regimes to attract institutional issuers. Still, none match the potential global reach of a federally sanctioned US stablecoin model.

A geopolitical amplifier

Stablecoins are embedding the dollar more deeply and rapidly into the transactional life of developing economies than the legacy eurodollar system ever did.

The expansion is occurring through private companies rather than state institutions, complicating traditional oversight and diplomatic channels.

As a result, even major economies are responding defensively. The European Central Bank (ECB) has cited the rise of US stablecoins as one catalyst behind accelerating plans for a digital euro, concerned they could dominate cross-border payments within the Eurozone.

For smaller economies, the stakes are sharper. Stablecoins weaken domestic currencies, challenge central-bank authority, and create a frictionless channel for capital outflows.

Yet they also reduce remittance costs, broaden access to stable savings products, and expose inefficiencies in legacy financial infrastructure.

They are simultaneously a financial upgrade and a systemic vulnerability.

As a result, the IMF’s concern is less about the technology itself and more about the speed of its adoption relative to the pace of regulatory coordination.

Stablecoins are growing faster than global frameworks can adjust, and their deepest penetration is occurring in economies least equipped to absorb the resulting shocks.

Stablecoins may have emerged from crypto markets, but they now sit at the front line of global monetary change.

By deepening the dollar’s reach, formalized through legislation like GENIUS, they reshape capital flows, challenge emerging-market stability, and redefine the distribution of monetary power.

Whether they evolve into a stable component of international finance or remain an ungoverned force will hinge on the next wave of global policy decisions and on how quickly the world adapts to the digital dollar era.

The post Stablecoins just eclipsed Bitcoin in the one metric that matters, exposing a $23 trillion global fault line appeared first on CryptoSlate.