Strategy (formerly MicroStrategy) expanded its Bitcoin holdings by purchasing of 196 BTC for $22.1 million at an average price of $113,048 per coin, according to a filing with the US Securities and Exchange Commission (SEC) dated Sept. 29.

According to the firm’s dashboard, this acquisition marks its third-smallest buy this year, following its 130 BTC in March and 154.64 BTC in August.

These incremental additions have increased Strategy’s total Bitcoin reserve to 649,031 BTC, representing 3% of the total BTC supply and making it the largest corporate BTC holder.

Meanwhile, the firm has spent roughly $47.35 billion on its position at an average cost of $73,983 per coin. With Bitcoin trading higher at more than $110,000, that stash is now worth $72.67 billion, translating into an unrealized profit margin of 53.47%.

The company disclosed that the purchases were financed through proceeds from at-the-market offerings of its Class A common stock (MSTR) and two perpetual preferred stock instruments, STRF and STRD.

Strategy confirmed it had raised $128 million through these equity sales, providing liquidity for continued accumulation.

MSTR stock falls

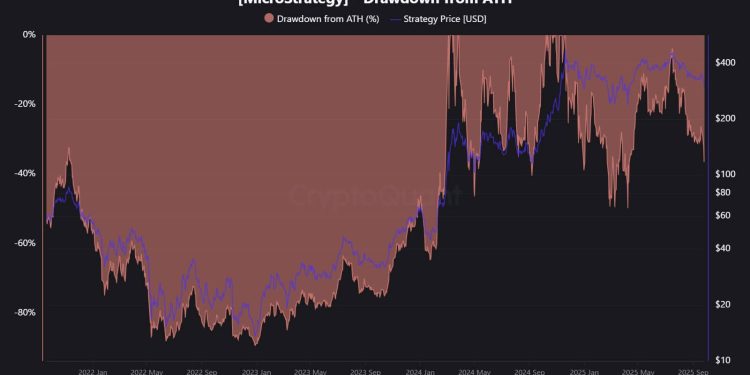

While the company continues to expand its Bitcoin position, its MSTR stock has been under pressure lately.

MSTR has fallen to its lowest level in six months, according to CryptoQuant analyst JA Maartun, who flagged the decline on Sept. 29. He noted that the sharp drop to near $300 reflects both heightened volatility and investor concerns.

Google Finance data shows that MSTR rallied to $455.90 in mid-July but has since retraced to approximately $309.06 by Sept. 26, resulting in a 32.5% loss over the past month. The decline contrasts with Bitcoin’s performance, which is up 22% year-to-date, compared to MSTR’s 11%.

The weaker stock performance has pushed Strategy’s market-adjusted net asset value (mNAV) down to 1.39x, the lowest level recorded in 2025.

Still, Strive Chief Risk Officer Jeff Walton argued that MSTR’s long-term returns remain resilient. He pointed out that even if mNAV fell to parity, MSTR would have outperformed Bitcoin more than 2x since the company adopted its Bitcoin-focused approach.

The post Strategy expands Bitcoin holdings to record 649,031 BTC despite MSTR stock slump appeared first on CryptoSlate.