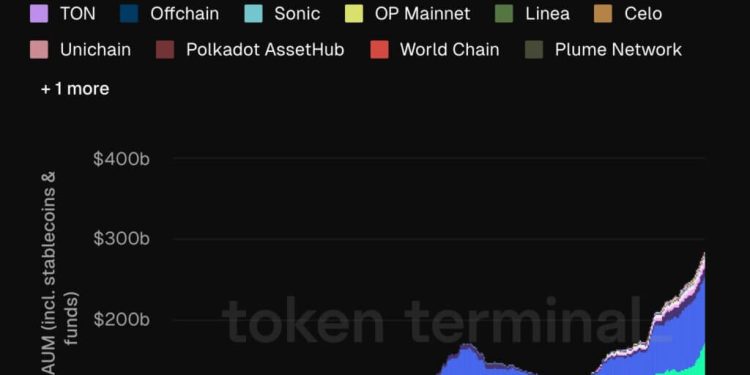

According to recent data by Token Terminal, tokenized real-world assets (RWAs) are already nearing $300 billion, a milestone that was projected to be reached in 2030. An additional report by RedStone Finance found that RWAs on-chain could hit as much as $30 trillion by 2034.

While most of the momentum is made up of stablecoins like USDT and USDC, with Ethereum and Tron emerging as the big winners in asset tokenization, don’t blink and miss the broader trend: stablecoins lead, but funds are rising.

On-chain funds, treasuries, and bonds are all rapidly carving out a bigger slice of the pie, moving capital markets from sleepy bank vaults onto global, blockchain rails that trade around the clock.

Tokenized RWAs: beyond dollars and stocks

Tokenized RWAs include much more than dollars in disguise. Earlier this week, Coinbase announced that it would launch Mag7 + Crypto Equity Index Futures to create the first US-listed futures product that combines traditional equities and crypto exposure.

Government bonds like Ondo USDY and BlackRock’s BUIDL, tokenized money-market funds, gold tokens such as PAXG, and even fractionalized real estate shares are now also a reality.

Commodities aren’t left behind either. There’s over $2.5 billion in digital gold, $500 million in tokenized oil, and millions in tokenized silver, agricultural goods, and even carbon credits.

Larry Fink, CEO of BlackRock, calls tokenization a “revolution” in investing, envisioning a future where “every asset can be tokenized” and traded with global reach and instant settlement.

This isn’t just fintech hype. According to McKinsey and Token Terminal, institutional adoption is ramping up; tokenized RWAs alone are set to double in size as funds and treasuries jump ship to the blockchain.

The implications of 24/7 access to traditional financial assets

The move beyond stablecoins highlights a new era for capital markets, and the implications are far-reaching. Imagine having 24/7 access to traditional financial (TradFi) assets, democratized by fractional shares, with no more waiting days for trades to settle.

Rather than relying on a centralized provider or a shadowy broker, every transaction is traceable and programmable, with assets directly managed on decentralized platforms, fast-tracking liquidity and efficiency.

As funds and institutional assets sprint on-chain, the $300 billion milestone that was expected to be hit in 2030 marks not just growth but a sea change: the financial system is stepping off Wall Street and into global, programmable networks, changing where (and how) finance happens.

Stablecoins were the start. Now, the tokenization wave is carrying funds, bonds, commodities, and even art. The next chapters? Real estate, private credit, and markets yet to be imagined, all open, frictionless, and unstoppable.

The post Tokenized assets are already nearing $300 billion led by stablecoins appeared first on CryptoSlate.