The post Top Crypto Market Events to Watch This Week: CPI, Fed Speakers, and Jobs Data appeared first on Coinpedia Fintech News

Crypto markets barely moved over the weekend after last week’s massive $700 billion selloff.

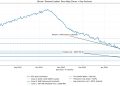

Bitcoin is currently trading at $69,875 after crashing toward $60,000, but it’s still deep in bear market territory and down 44% from its all-time high.

This week could change things. Five major economic releases and five Fed speakers are lined up, and each one has the potential to move markets.

Delayed Retail Sales Data on Tuesday

December retail sales, pushed back due to the government shutdown, are expected at 0.4% month-over-month, down from 0.6% in November. This gives a read on how consumers are spending, and weaker numbers could push rate cut expectations forward.

January Jobs Report on Wednesday Is the Big One

Nonfarm payrolls are expected at 80K, up from 50K in December. Unemployment is projected to hold at 4.4%.

CNBC’s Jim Cramer called it directly: “The most important thing, believe it or not, is the Labor Department’s nonfarm payroll report on Wednesday. If that comes in soft, it means the Fed can keep cutting rates, and that’s great news for the stock market itself.”

Soft jobs data would be bullish for crypto. Strong numbers would do the opposite.

Coinbase Earnings on Thursday

Coinbase reports earnings on Thursday, which will reflect exactly how the recent downturn has hit trading volumes and revenue, giving investors a ground-level view of crypto market health.

Robinhood reports on Tuesday, with crypto revenue expected down 28% to $259 million despite overall revenue rising 34%.

CPI Inflation Report Closes the Week on Friday

January’s Consumer Price Index is expected to show year-over-year inflation cooling to 2.5% from 2.7%. But core CPI month-over-month is projected at 0.31%, up from 0.20% in December. BofA economists expect inflation picked up at the start of 2026.

The Fed still sees inflation as “somewhat elevated.” If CPI comes in hot, rate cut hopes get pushed further out.

Five Fed Speakers Add to the Mix

Governor Christopher Waller, Atlanta Fed President Raphael Bostic, Cleveland Fed President Beth Hammack, Vice Chair Michelle Bowman, and Governor Stephen Miran all speak this week. Markets currently price no rate cut until June, with two quarter-point cuts expected by December.

Senior strategist Angelo Kourkafas at Edward Jones said, “We’ll see if any either weakness in the labor market data or any surprising cool-down in inflation accelerates a bit the timeline for when the market thinks the next rate cut may be delivered.”

What Crypto Traders Should Watch

Weak jobs data and cooling inflation would strengthen the case for rate cuts, giving Bitcoin and altcoins room to bounce. Strong economic numbers or hawkish Fed commentary would likely keep pressure on crypto prices.

Also Read: Crypto Analyst Warns Bitcoin Could Hit Zero, Lays Out 16-Step ‘Doomsday’ Scenario

After a major wipeout, this week’s data could determine whether crypto finds a floor or keeps falling.