The post VivoPower Aims to Become the First US Firm to Offer Exposure in Ripple and XRP appeared first on Coinpedia Fintech News

On Friday, VivoPower International PLC, a Nasdaq-listed solar power company, announced that it plans to purchase $100 million worth of Ripple Labs Shares. With this deal, the company is planning to expand its XRP-focused digital asset treasury with a discount to current market prices.

VivoPower Shares Surge 32%

VivoPower’s bold $100 million bet on Ripple equity and XRP tokens has significantly boosted investors’ confidence, sending its shares sharply higher by 32.12% to $5.10. Kevin Chin, Executive Chairman and CEO of VivoPower, said this initiative aligns with the company’s objective of building a sustainable, long-term treasury model with significant upside potential for shareholders.

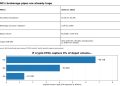

This purchase will allow VivoPower to gain indirect exposure to XRP at a cost of about $0.47 per token, which is an 86% discount to current market prices.

Former Ripple board member, who serves as the current Chairman of VivoPower’s Advisory Board, Adam Traidman stated, “By purchasing Ripple shares, not only will VivoPower acquire XRP at valuations up to an 86% discount versus buying XRP outright on the market, we will also gain a stake in Ripple’s RLUSD stablecoin and its other business units, including Hidden Road, Rail, and Metaco.”

Moreover, the company will have full and direct legal title to the purchased Ripple shares, and it will be recorded as a shareholder directly on Ripple’s cap table.

Ripple Expands Its Stablecoin Business

Partnering with Ripple can positively impact VivoPower’s participation rate, as the crypto company is rapidly growing. Currently, it is actively expanding its business in stablecoins with a significant partnership with BNY Mellon. The company appointed BNY Mellon as the primary custodian for Ripple’s US dollar-pegged stablecoin reserves, RLUSD.

This partnership will enhance regulatory compliance for Ripple while boosting confidence in the crypto investors to build a fast-growing stablecoin institution.

Emily Portney, global head of asset servicing at BNY, said in a statement, “As primary custodian, we are thrilled to support the growth and adoption of RLUSD by facilitating the seamless movement of reserve assets and cash to support conversions and are proud to be working closely with Ripple to continue propelling the future of the financial system.”

Additionally, VivoPower also approved the fact that Ripple is currently the largest holder of XRP tokens, with 41 billion valued at approximately US$135 billion at the current XRP price. This reflects a credible trust in the partnership between Ripple and VivoPower.