The Depository Trust & Clearing Corporation spent 2025 building infrastructure for extended trading hours, targeting a 24×5 schedule that would keep US markets open from Sunday night through Friday evening with brief daily maintenance windows.

Nasdaq filed plans for 23-hour trading days. Intercontinental Exchange (ICE) announced it has developed a tokenized securities platform that is designed to enable “24/7 operations.”

The industry framed the shift as transformative: always-on access for retail investors, parity with crypto’s round-the-clock structure, modernization of decades-old plumbing.

Meanwhile, Binance listed a silver perpetual contract on Jan. 7 that trades 24/7 with up to 50x leverage and is cash-settled in USDT.

Hyperliquid’s silver-linked perpetual printed over $4.5 billion in volume during January, with open interest around $152.4 million and funding rates hovering near neutral, suggesting two-way flow rather than purely speculative long positioning.

The same venues also offer synthetic exposure to Tesla shares, 24/7 and stablecoin-margined. Wall Street is engineering a transition to near-continuous trading, while crypto derivatives markets already run continuously, referencing the same real-world prices traditional finance wants to quote after hours.

This is not about tokenized securities with shareholder rights or on-chain settlement of equity ownership. These are perpetual futures, derivatives that track reference prices for commodities, stocks, or indices, margined and settled in stablecoins.

The distinction matters because it defines what “already here” actually means: continuous synthetic exposure to real-world asset prices, not the assets themselves. Yet, for price discovery, risk transfer, and speculative positioning, the functional difference collapses.

If an investor wants to express a view on silver or Tesla at 3 am on a Sunday, crypto derivatives markets are the only liquid venue.

The infrastructure gap

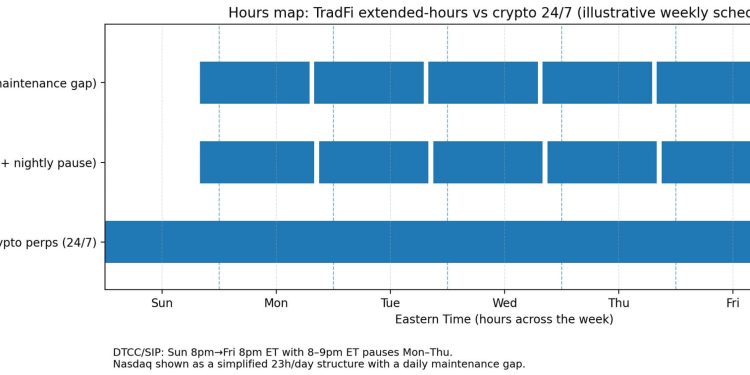

The DTCC’s extended-hours plan explicitly describes a 24×5 structure: markets open on Sunday at 8 pm Eastern and close on Friday at 8 pm Eastern, with a one-hour technical pause between 8 and 9 pm each weeknight.

SEC filings for securities information processors, which are the systems that consolidate and distribute market data, match the same operational window. Nasdaq’s 23-hour structure is divided into day and night sessions, with a maintenance gap.

These pauses exist not as legacy artifacts, but as structural requirements: trade-date assignment, dividend processing, corporate action reconciliation, and settlement workflows all depend on discrete daily boundaries.

NYSE and ICE have discussed a separate initiative, consisting of a tokenized trading venue aiming for true 24/7 operations, but execution remains contingent on regulatory approval and building entirely new infrastructure.

The near-term reality for traditional markets is 23 hours a day, five days a week, with weekends dark and nightly pauses mandatory.

Crypto perpetual contracts face no such constraints.

They run on programmatic risk engines that continuously margin positions, liquidate underwater accounts automatically, and settle in stablecoins that transfer instantly, without clearing intermediaries or T+1 settlement cycles.

There is no trade date to assign, no share registry to reconcile, no corporate action calendar to process.

What “working fine” actually means

Hyperliquid’s silver perpetual achieved top-tier liquidity within weeks of launch. As of Jan. 27, it traded over $4.5 billion in monthly volume, with a volume-to-open-interest ratio of 7.8%, suggesting high turnover.

The numbers reflect a characteristic of liquid markets: participants can enter and exit positions without significantly moving prices.

Binance’s XAGUSDT contract, launched Jan. 7 at 10:00 UTC, offers up to 50x leverage on one troy ounce of silver priced in dollars. The venue also lists equity-linked perpetuals and markets them as 24/7 synthetic exposure without ownership.

Binance discloses index components and actively adjusts weightings, signaling that these are derivatives tied to reference prices rather than tokenized shares.

Hyperliquid’s infrastructure relies on validators publishing oracle prices roughly every three seconds, with mark prices used for margining and liquidations to prevent manipulation during low-liquidity windows.

| Venue | Instrument | Launch/Status | Trading hours | Margin/Settlement | Reference price basis |

|---|---|---|---|---|---|

| Binance | XAGUSDT perpetual (silver) | Launched Jan 7, 2026 (USDⓈ-M) | 24/7 | USDT-margined, cash-settled perp | Index/oracle-style reference to silver (1 troy oz USD) |

| Hyperliquid | SILVER-USDC perpetual (silver) | Live (actively traded) | 24/7 | Stablecoin-margined perp (on-chain settlement) | Oracle + mark price mechanism for margining/liquidations |

“Working fine” in this context means continuous pricing, continuous risk transfer, and sufficient depth to support meaningful position sizes without excessive slippage.

Yet, it does not mean these markets are safer than traditional finance or immune to the risks inherent in leveraged derivatives. Synthetic markets can decouple from underlying spot prices when reference markets close, liquidity thins, or oracle inputs lag.

The claim is not that crypto derivatives are superior risk management, but that they already provide the always-on access traditional finance is still engineering.

The distribution moat is real, but execution quality varies

Kunal Doshi, an analyst at Blockworks, noted that Hyperliquid’s silver perpetual traded roughly 35% of Binance’s volume with comparable spreads and depth.

The figure illustrates how execution quality can compete with distribution scale, as Binance’s user base dwarfs Hyperliquid’s, yet the smaller venue captures meaningful market share through competitive liquidity provision.

The metrics that matter to traders, such as top-of-book spreads, depth within 10 and 25 basis points, and slippage on large orders, show that Hyperliquid can match or exceed Binance’s execution, despite operating without KYC requirements and listing contracts faster than regulated venues.

The tradeoff between access and execution defines the current competitive landscape.

Binance offers regulatory licenses in multiple jurisdictions, fiat on-ramps, and a decade of operational history. Hyperliquid runs entirely on-chain with transparent settlement and faster experimentation cycles.

Both provide 24/7 synthetic exposure to silver and equities that traditional markets cannot yet offer continuously. Distribution scale matters for reaching users, while execution quality matters for keeping them.

What happens when traditional finance goes 23/5

The scenario range over the next six to eighteen months depends on how quickly traditional infrastructure adapts.

In the base case, traditional markets move to 23-hour weekdays with weekends dark, crypto perpetuals retain exclusive claim to weekend price discovery and after-hours risk transfer.

Crypto’s structural edge remains weekends, faster listing cycles, and experimentation with new synthetic products that would take months to clear regulatory approval in traditional venues.

A compression scenario sees traditional finance’s 23/5 operations reduce crypto’s weekday after-hours advantage. If US equity markets quote Monday through Friday with only one-hour pauses, the window during which crypto derivatives offer exclusive access shrinks dramatically.

Crypto retains weekends and maintains an edge on speed-to-market for new products, but loses the “TradFi is closed” arbitrage that currently drives weekend volume.

The breakout case involves tokenized venues achieving true 24/7 operations with stablecoin settlement and programmatic clearing.

NYSE and ICE have signaled intent: execution depends on regulatory green lights and building infrastructure that bypasses traditional clearing and settlement bottlenecks. The timeline remains uncertain, but the destination is clear.

Synthetic exposure is the leading edge

What already exists is synthetic 24/7 exposure to real-world prices through derivatives margined in stablecoins.

What does not yet exist is tokenized securities with full shareholder rights trading continuously on-chain with regulatory clarity. The distinction is critical.

Crypto perpetual contracts do not confer ownership, voting rights, or dividend claims. They provide price exposure and leverage, nothing more. Nevertheless, for the vast majority of trading activity, ownership rights are irrelevant.

Traditional finance is building toward 24/5 because its infrastructure cannot yet support true continuous operations without breaking trade-date logic, corporate action processing, and settlement workflows that took decades to standardize.

Crypto skipped those constraints entirely by building derivatives that reference prices rather than transferring ownership. No share registry means no need to pause for reconciliation. No T+1 settlement means no need for nightly cutoffs. No corporate actions means no need to freeze trading for dividend processing.

Wall Street’s 24/7 ambitions are not hypothetical, they are active infrastructure projects with public timelines and regulatory filings. But the headline already undersells the present.

Crypto markets trade silver, Tesla, gold, and dozens of other real-world assets continuously right now, with billion-dollar daily volumes and institutional-grade liquidity. The future of traditional finance is already operational, just on different rails.

The post Wall Street bragging about 24-hour trading ignores the $4.5 billion crypto market that never actually closes its doors appeared first on CryptoSlate.